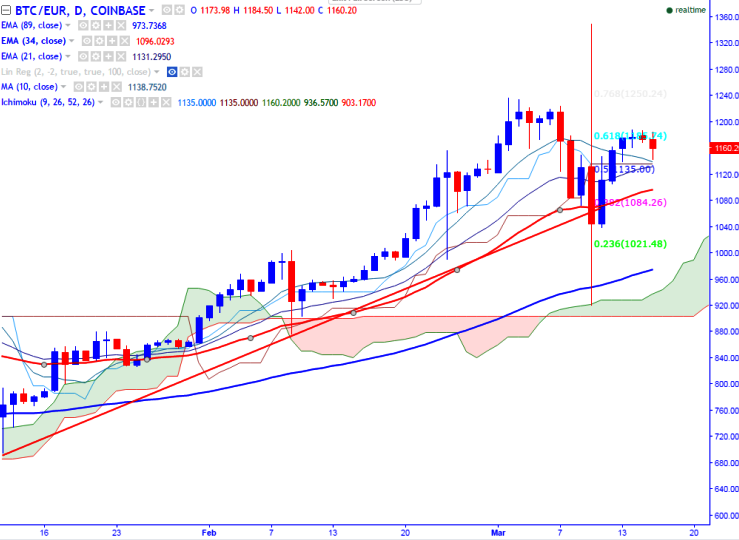

BTC/EUR is consolidating in narrow range for the past four trading session between 1105 and 1188 after huge sell-off on Mar 10th 2017. The pair jumped till 1188 and is facing strong psychological resistance at 1200 (COINBASE). It is currently trading around 1161 at press time.

Ichimoku analysis of daily chart indicates:

Tenkan-Sen level: 1135

Kijun-Sen level: 1135

Major reversal level -969 (89- day EMA)

Long-term trend remains to be bullish. The pair declined till 1142 (10- day MA) at the time of writing and shown a mild recovery. So further minor weakness can be seen below 10- day MA and any minor weakness can be seen only below that level.

Major resistance is around 1200 and any break above will take the pair to next level till 1236 (Mar 2nd high) /1350 (Mar 10th high)/1405 (113% retracement of 1350 and 920). Short term support is seen at 1142 (10- day MA) and any break below will drag the pair till 1123 (23.6% retracement of 920 and 1188) /1092 (34- day EMA)/1047 (50% retracement of 920 and 1350)/969 (89- day EMA)

FxWirePro: BTC/EUR downside capped by 10- day MA, good to buy on dips

Thursday, March 16, 2017 7:30 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary