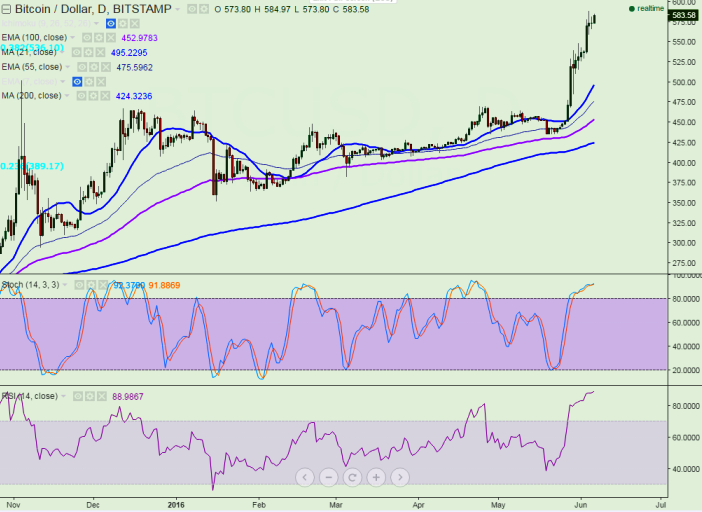

- BTC/USD is trading stronger and jumped till $588 on Friday. It is currently trading around $580.

- The pair is facing psychological resistance around $600 and the break will take the pair till $630 (161.8% retracement of $502 and $294)/654/$773 in the short term.

- Short term trend is bullish as long as support $549 (7 day EMA and also resistance turned into support) holds.

- The pair’s support is around $549 (7 day EMA) and any violation below targets $525/$490 (61.8% retracement of $435 and $588.50)/$470 (resistance turned into support).

- Short term trend reversal only below $435 (20th May low).

It is good to buy around $540 with SL around $490 for the TP of $630/$654/$770