Ichimoku analysis (4-hour chart)

Tenken-Sen- $56900

Kijun-Sen- $57501

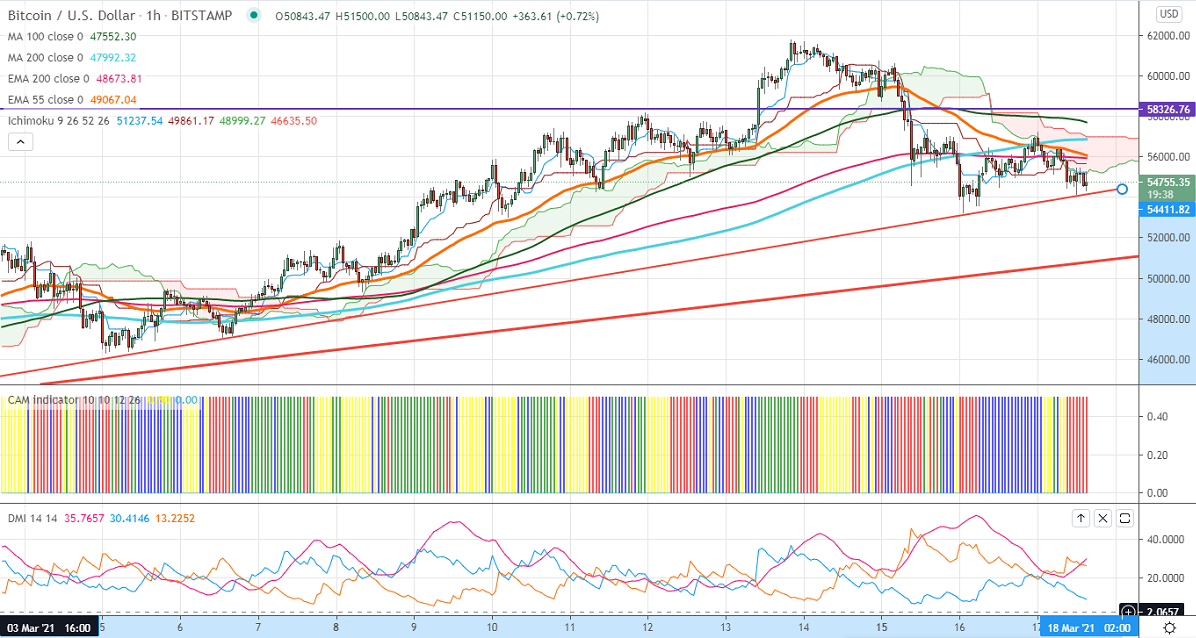

BTCUSD declined after a minor jump above 200-H MA. The intraday trend is slightly on the lower side, as long as resistance $58000 holds. The pair is holding below Hourly Tenken-Sen and Kijun-Sen. Any below $53000 confirms minor bearishness, a dip till $52300/$51300/$51500 (200- 4H EMA) is possible. On Mar 16th, 2021 the pair took support near the trend line joining $43019 and $46529.This confirms shows that BTCUSD must close below $54000 for further minor weakness. The support to be watched is $53000.

The pair's near-term resistance is around $58000.Any further bullishness can be seen if it breaks above that level. A jump till $62000/$65000 is possible.

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $60000 with SL around $61700 for TP of $50000/$49300