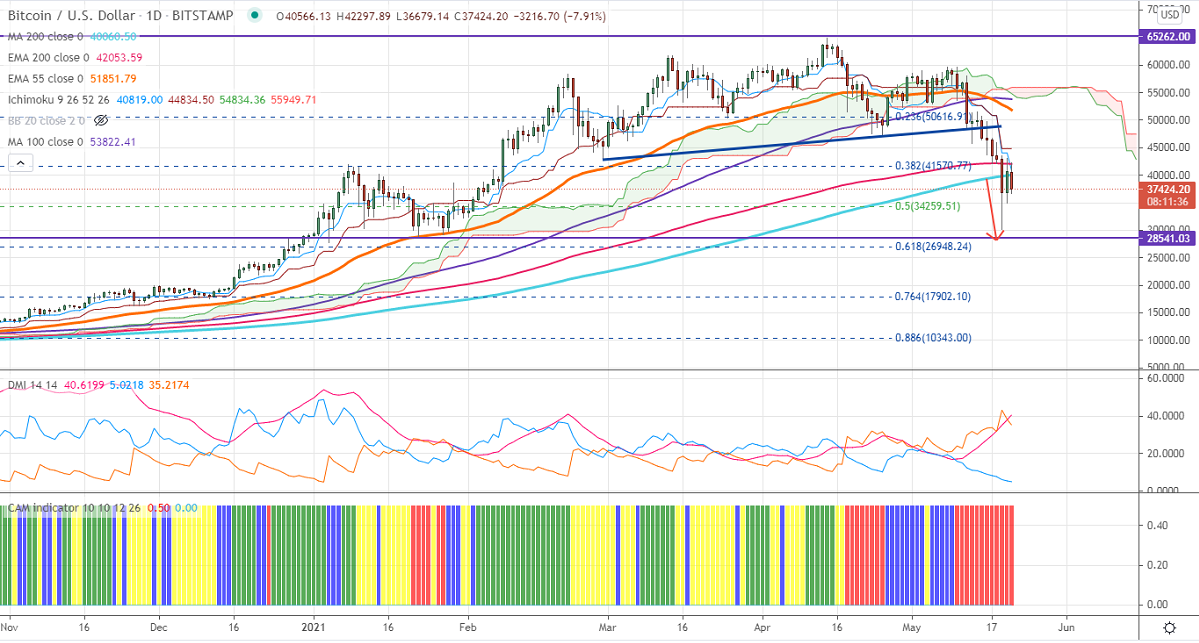

Ichimoku analysis (Daily chart)

Tenken-Sen- $44043

Kijun-Sen- $44834

BTCUSD declined sharply after a pullback to $43000. The Chinese authorities said that it is necessary to "crackdown on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to the social field.". The pair has once again broken significant support at $399411 (200- day MA). This confirms bearish trend continuation; a dip till $28800 is possible. The intraday trend is still on the lower side as long as resistance $43000 holds. It hits an intraday high of $42297 and is currently trading around $37300.

The near-term resistance is around $43000. Any indicative break above targets $44780/$47000. Short-term trend continuation above $47000.

The pair's minor support is around $35000. Any convincing break below will drag the pair down to $30000/$28392/$26948 (61.8% fib). Any close below $26900 will drag the pair down to $20000.

Indicator (Daily chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $40500 with SL around $43000 for TP of $28500.