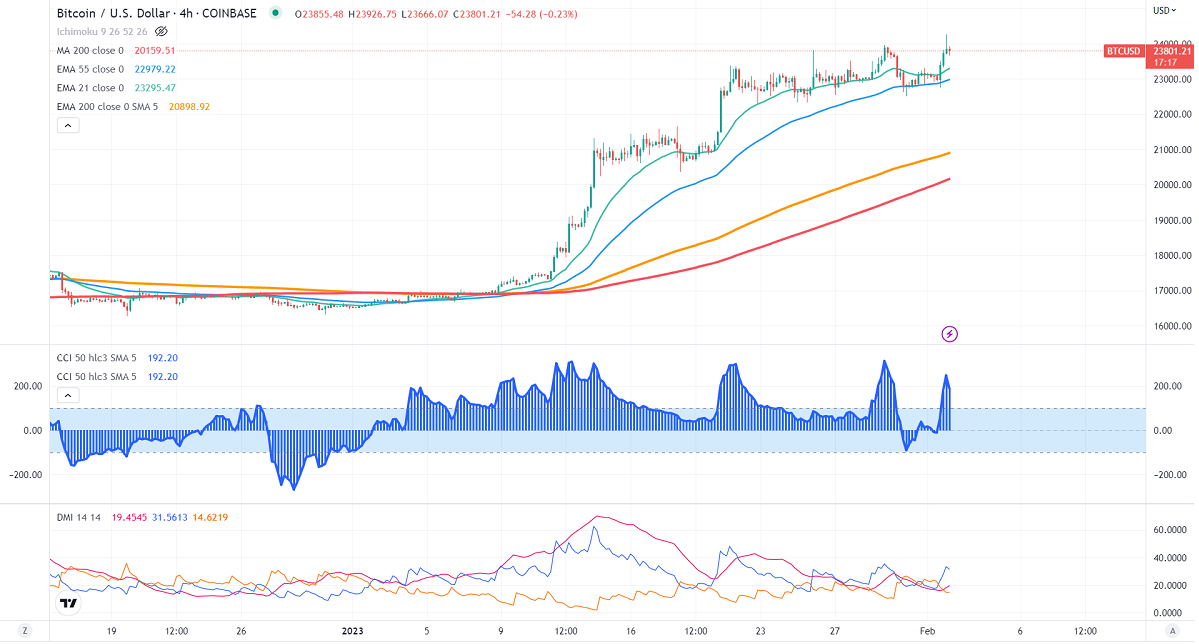

BTCUSD is trading higher for the fourth consecutive week on upbeat market sentiment. The central bank raised rates by 25 bpbs and promises further small rate hikes in the coming months. It has mentioned, "Inflation has eased somewhat but remains elevated."It hits a high of $24258 and is currently trading around $23782.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC)- Bullish (Positive for BTC). The index gained sharply after the less hawkish rate hike. Any consecutive close above 12600 will push the NASDAQ to 13000.

US bond yields (Bearish)- Bullish for BTC. The US 10-year yield is trading lower for the second consecutive day. Any close below 3.26% confirms minor bearishness. The yield spread between 10 and 2-year narrowed to -69.80 basis points from -75 bpbs.

Technicals-

Major support- $22700. Any break below will take you to the next level at $20000/$19570.

Bull case-

Primary supply zone -$25000. The breach above $25000 confirms minor bullishness. A jump to the next level of $25600/$30000 is possible.

Secondary barrier- $30000. A close above that barrier targets $32375/$36000.

It is good to buy on dips around $22500 with SL around $20000 for TP of $30000.