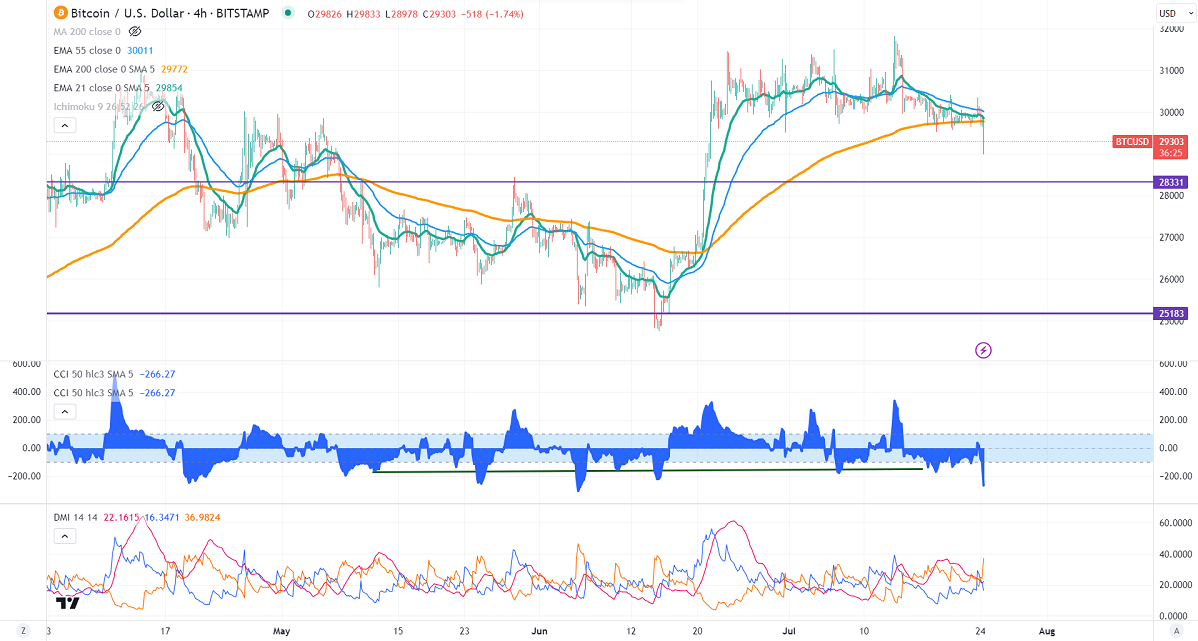

BTCUSD lost its shine on Alphapo's hot wallet hack. It was hacked for over $ 31 million in Ethereum, Tron, and Bitcoin. Markets eye US Fed monetary policy for further direction.BTC hits a low of $28978 and currently trading around $29311.

Major economic data for the week

Jul 24th, 2023, US Flash Manufacturing PMI (8:00 am GMT)

Jul 25th, 2023, German Ifo business climate (12:30 pm GMT)

CB consumer confidence and Richmond manufacturing Index (2:00 pm GMT)

Jul 26th, 2023, FOMC statement (6:00 pm GMT)

Jul 27th, 2023, ECB Main Refinancing Rate (12:15 pm GMT)

US Advance GDP q/q and durable goods order (12:30 pm GMT)

Jul 28th, 2023, US Core PCE index m/m (12:30 pm GMT)

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC) - Bullish (neutral for BTC). The correlation between Bitcoin and NASDAQ diverged and 90 -the day correlation dropped to almost zero. Any weekly close above 16000 will take the index to 17000.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 99.80% from 96.70% a week ago.

Technicals-

Major support- $27500. Any break below will take it to the next level at $25000/$23800/$23300 if possible.

Bull case-

Primary supply zone -$32000. The breach above confirms minor bullishness. A jump to the next level of $36300/$40300/$41349 is possible.

Secondary barrier- $42600. A close above that barrier targets $48800/$50000.

It is good to buy on dips around $27500-600 with SL around $24500 for TP of $35000/$40000.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary