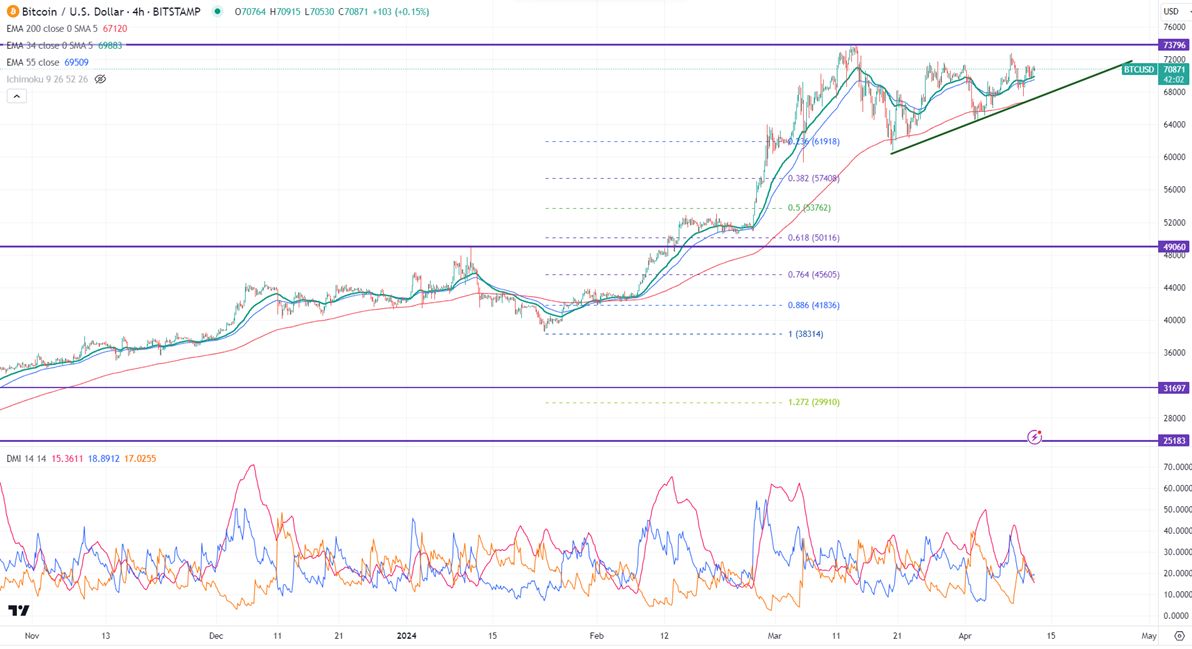

BTCUSD is consolidating in a narrow range between $65999 and $72756 for the past week. It hit a high of $71287 and is currently trading around $70762.

Halving date- Apr 20th, 2024.

Honkong’s Securities and Futures Commission (SFC) is likely to approve BTC ETF next week, according to Reuters. Bitcoin’s relative realized profit which, is lower now at 1.8% compared to 3$ in 2021, according to Glassnode data.

US markets -

NASDAQ (negative correlation with BTC) - Bullish (neutral for BTC). The NASDAQ has shown a minor pullback after weak US PPI data. Any close below 18000 will take the index to 17700/17300.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in June decreased to 23.80% from 59.10% a week ago.

Technicals-

BTCUSD trades above the short-term moving average (21 and 55 EMA) and the long-term moving average (200 EMA) in the 4-hour chart.

Minor support- $69000. Any break below will take it to the next level at $68300/$67000/$64500/$6300.

Bull case-

Primary supply zone -$73500. Any break above confirms a bullish continuation. A jump to $75000/$80000 is possible.

Secondary barrier- $80000. A close above that barrier targets $100000.

It is good to buy on dips around $65000 with SL around $61800 for TP of $75000.