BTCUSD showed a minor recovery on positive market sentiment. It hit a high of $61424 and is currently trading at around $60543.

According to santiment data, BTC whales have accumulated 94700 BTC in the past six weeks. BTC ETF saw an inflow of $62.10 million yesterday, according to Coinglass data.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep increased to 75% from 47% a day ago.

US markets -

NASDAQ (negative correlation with BTC) - Bearish (neutral for BTC). The NASDAQ trades higher on strong US economic data. Any close above 1900 will take the index to 20000.

Technicals-

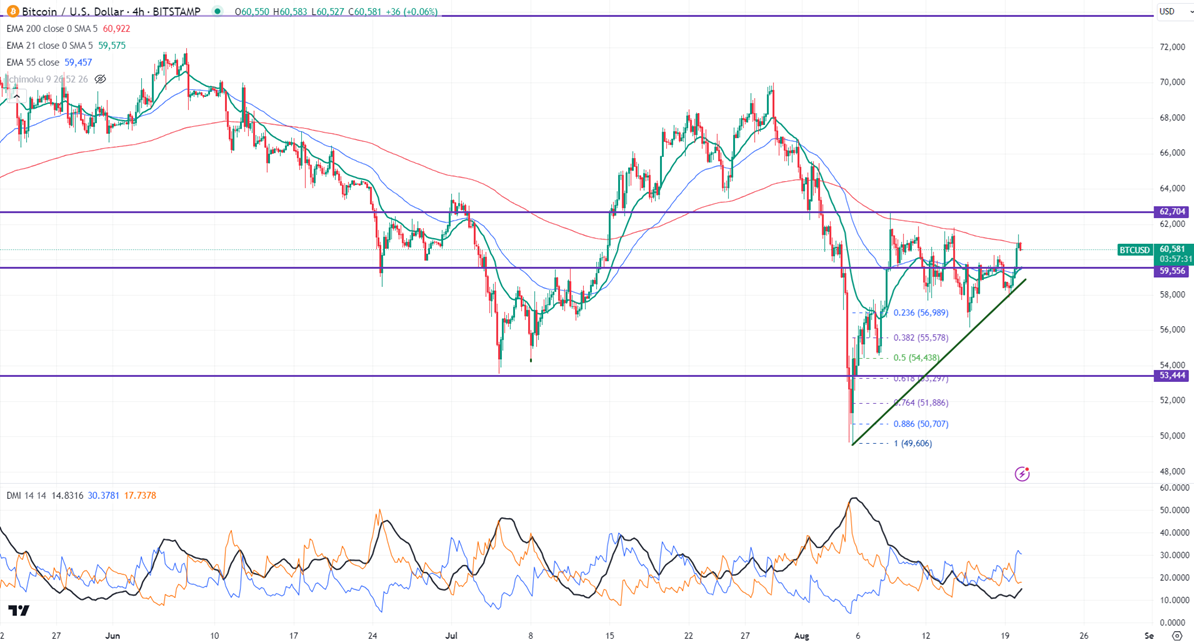

BTCUSD trades above the short-term moving average 21 EMA,55 EMA and the long-term moving average (200 EMA) in the 4-hour chart.

Minor support- $57000. Any break below will take it to the next level at $54500-/$53000/$50000/$46000.

Bull case-

Primary supply zone -$63000. Any break above confirms a bullish continuation. A jump to $65000/$67000/$70000 is possible.

Secondary barrier- $70000. A close above that barrier targets $750000/$80000.

It is good to buy on dips around $55000 with SL around $52000 for TP of $63000/$67000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary