BTCUSD trades flat despite mixed US PPI. It hit a high of $58470 and is currently trading at around $57693.

|

Time (GMT) |

Currency |

Event |

Actual |

Forecast |

Previous |

|

12:30 pm |

US |

PPI y/y |

1.7% |

1.8% |

2.2% |

|

|

|

Core PPI y/y |

2.4% |

2.5% |

2.4% |

|

|

|

PPI m/m |

0.20% |

0.10% |

0% |

|

|

|

Core PPI m//m |

0.30% |

0.20% |

0% |

|

|

US |

Unemployment claims |

230K |

227K |

228K |

BTC ETF has seen outflows of $43.97 million on Wednesday mainly led by ARK Invest recorded $54.03 million, According to SoSoValue.

Coinglass’s Binance BTC Long to Short ratio above 1 indicates bullishness.

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep increased to 67% from 56% a week ago.

US markets -

NASDAQ (No correlation with BTC) - Bearish (neutral for BTC). The NASDAQQ trades flat ahead of US CPI. Any close below 18000 will take the index to 17400.

Technicals-

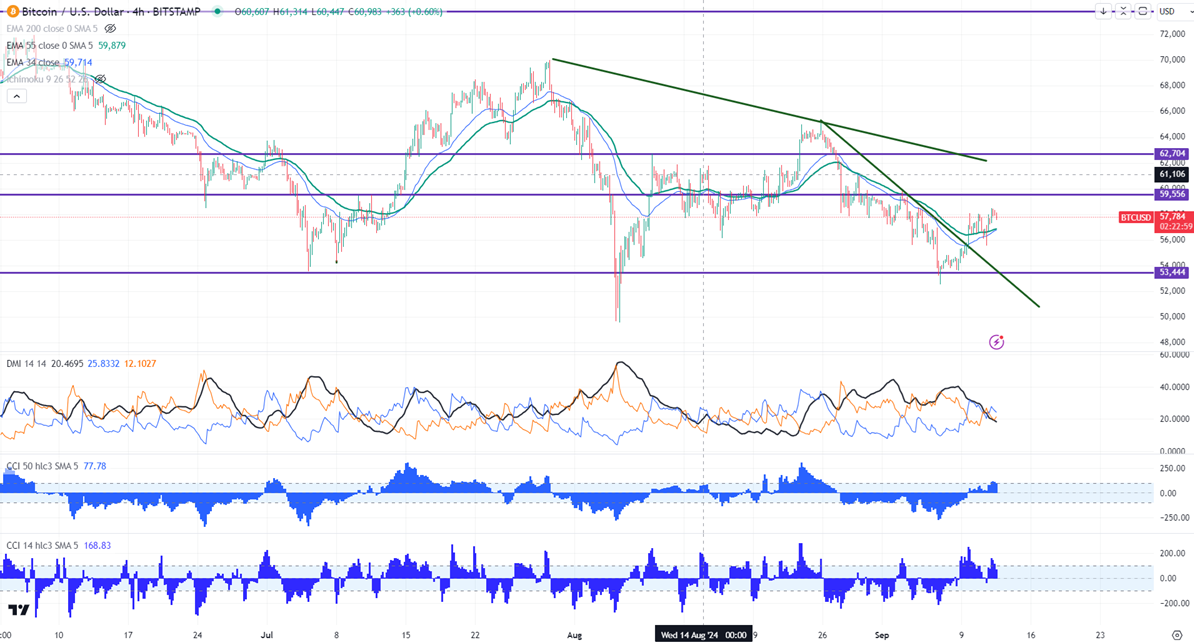

BTCUSD trades above the short-term moving average 34- EMA and 55 EMA and below the long-term moving average (200 EMA) in the 4-hour chart.

In the daily chart, BTC holds below short and long-term moving averages. This confirms minor weakness.

Minor support- $55000. Any break below will take it to the next level at $52500/$50000/$46000.

Bull case-

Primary supply zone -$58975. Any break above confirms an intraday bullishness. A jump to $60000/$61800/$63000/$65000/$67000/$70000 is possible.

Secondary barrier- $70000. A close above that barrier targets $750000/$80000.

Indicator (4-hour chart)

CCI (14)- Neutral

CCI (50)- Bullish

Average directional movement Index - Neutral

It is good to buy on dips around $55000 with SL around $52000 for TP of $67000.