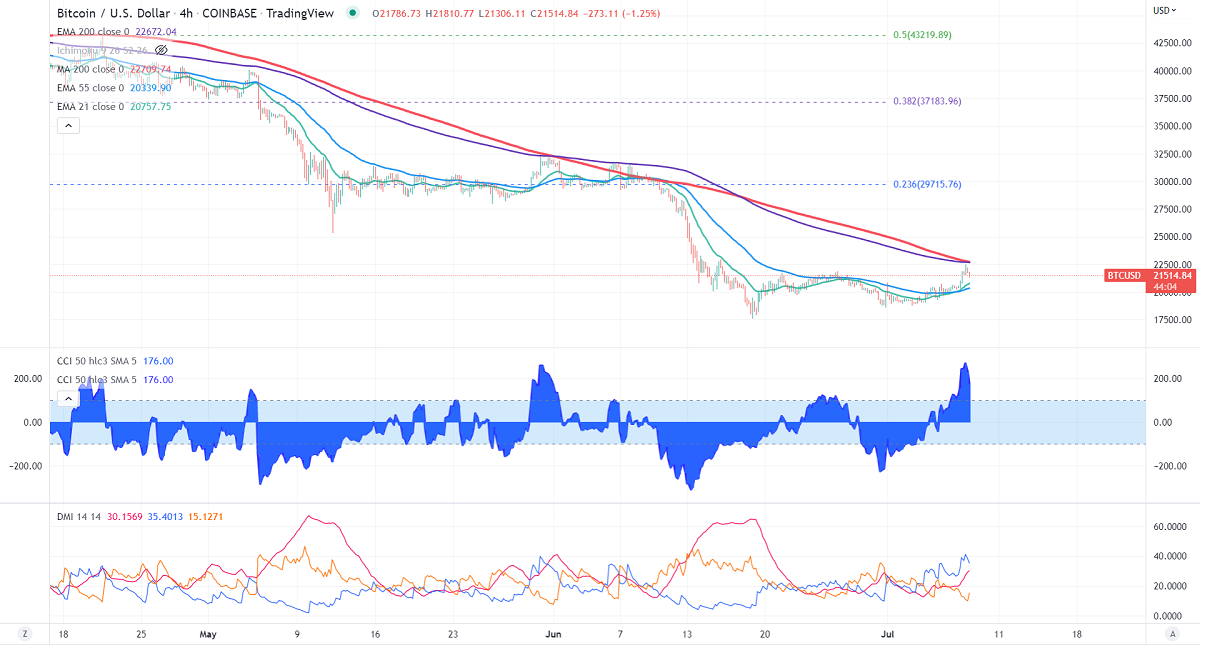

Strength of BTC calculated based EMA in 4-Hour chart

| Pair | Value | Recommendation |

| BTCUSD | 85.64 | Neutral |

BTCUSD showed a dead cat bounce after a massive sell-off. The pullback in equities is supporting BTC at lower levels. Market eyes US Non-farm payroll for further direction. Mt.Gox releases updates on Bitcoin repayment could put pressure on the pair at higher levels. It hits a high of $22490 at the time of writing and currently trading around $21580.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC)- Positive (Bullish for BTC). The index holds above 12000 after forming a bottom of 11316. Any close above 12250 confirms a bullish continuation.

US bond yields (Weak)-Positive for BTC. US 10-year yield gained 10% from the minor bottom 2.74%.

Technicals-

Major support- $21000. Any break below will take the pair to next level $20000/$18600/$17500/$16200 is possible.

Bull case-

Primary supply zone -$22500. The breach above confirms minor bullishness. A jump to the next level of $25400/$30000 is possible.

Secondary barrier- $33000. A close above that barrier targets $37000/$4000.

It is good to sell on rallies around $22280-300 with SL around $25000 for TP of $15000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary