GBP vols bounced this week after PM May called a snap general election. 1M ATMs are up 0.5 pts. on the week, while 2M expiries that cover the June 8th election date are 0.7 pts. higher to account for the increased event weight.

We have no quarrel with this re-pricing: an information shock that delivers a 2.5% intra-day range in the spot with risks of follow-through in coming days via forced liquidation of one-way short spec positions (basis IMMs) can and should push up gamma vols.

The election event itself is not particularly binary given the extent of the Conservative polling lead, hence day-weight should be significantly smaller than for the Brexit referendum or the French elections.

Nonetheless, GBP gamma is a worthy buy, especially in the likes of GBPCAD, GBPAUD and GBPNZD that all look cheap on our screens, purely because of the likely whipsaw in the pound going forward as the market turns its attention to assessing the full implications of the change in British political landscape once the French vote is out of the way.

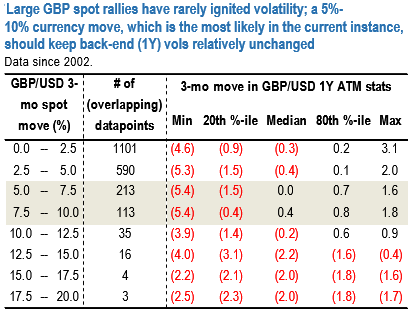

GBP gamma can perform near term as deep underweight spec positions are liquidated; GBPAUD, GBPCAD and GBPNZD screen cheap. Longer-dated (6M-1Y) GBP vol should remain contained, however; we are biased to sell 9M-1Y GBP vega on rallies.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics