- AUD/JPY recovery fails to hold gains above 5-DMA, extends downside for 4th successive session.

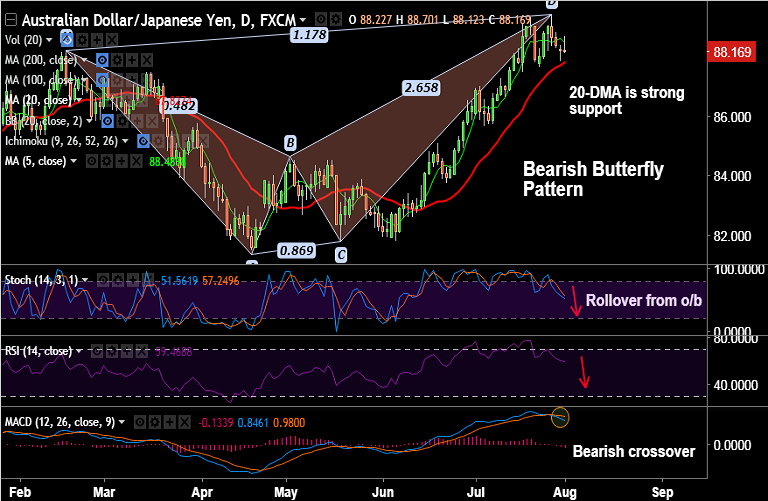

- Technical studies are turning bearish. RSI and stochs are biased lower. MACD is showing a bearish crossover on signal line.

- We see a 'Bearish Butterfly' formation on daily charts which raises scope for downside.

- The pair has been struggling to extend gains above weekly 200-SMA at 88.64.

- 20-DMA is strong support at 87.82, break below could see extension of downside.

Support levels - 87.82 (converged 20-DMA & weekly 5-SMA), 87.55 (23.6% Fib retrace of 81.486 to 89.425 rally), 87

Resistance levels - 88.49 (5-DMA), 88.64 (weekly 200-SMA), 89, 89.42 (July 27 high)

Recommendation: Good to go short on decisive break below 20-DMA at 87.82, SL: 88.50, TP: 87.55/ 87/ 86.40

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -121.996 (Highly Bearish), while Hourly JPY Spot Index was at -5.62818 (Neutral) at 1140 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest