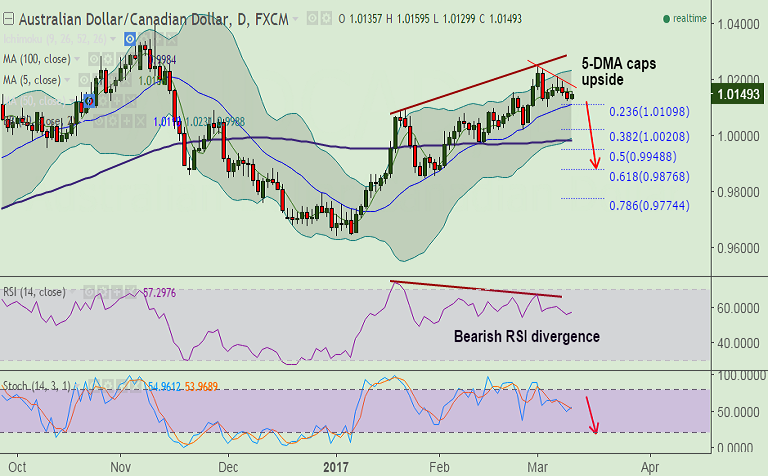

- AUD/CAD trades a narrow range, 5-DMA caps upside, intraday bias lower.

- Bearish divergence on RSI builds scope for downside in the pair. Break below 20-DMA will confirm downside.

- Technical studies are bearish, Stochs are biased lower and MACD line is showing a bearish crossover on signal line.

- Downside likely to test 100-DMA at 0.9983. Bearish invalidation only above trendline resistance at 1.0185.

- Violation at 100-DMA finds next major support at daily cloud by 0.9925.

Support levels - 1.0110 (20-DMA), 1.010 (23.6% Fib retrace of 0.96439 to 1.02537 rally), 1.00 (38.2% Fib and Feb 24 low), 0.9984 (100-DMA)

Resistance levels - 1.0158 (5-DMA), 1.0185 (trendline), 1.0215 (Mar 7 high)

TIME TREND INDEX OB/OS INDEX

1H Bearish Neutral

4H Neutral Neutral

1D Neutral Neutral

1W Bullish Neutral

Recommendation: Good to go short on break below 20-DMA at 1.0110, SL: 1.0158, TP: 1.00/ 0.9985

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -68.7918(Bearish), while Hourly CAD Spot Index was at 23.6841 (Neutral) at 0820 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.