In this write-up, we emphasize on longs in CME gold, at the end of April, the dollar definitively broke out of a narrow range established since mid-January. The move higher in the 10-year Treasury yield was chiefly cited as the driver for the 2% move higher in the broad dollar index. The dollar’s resurgence since April 18 synced with the surge in yields but also the 2% drop in spot gold prices.

This sequence of events would normally be considered mundane were it not for the fact that the typical persistently-negative relationship between yields (both nominal and real, short-term and intermediate), and the gold price has broken down since last October.

It is still early days and debatable whether the period of decorrelation has ended. Given that our FX strategists maintain forecasts for a weaker USD over the next couple of quarters, we prefer to keep our long gold trade recommendation in place for now.

OTC outlook:

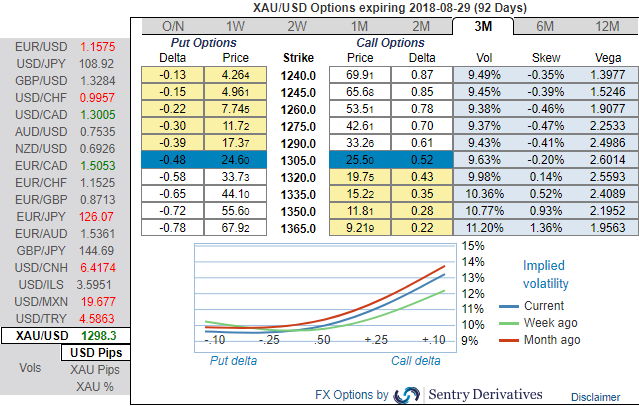

As you can see 3m IV skews, that have been indicating potential upside risks, this signifies the hedgers’ interests on both OTM call strikes. While bullish neutral risk reversals have been indicating hedging sentiments for the upside risks remain intact, accordingly, deploying three-leg options strategy would be a smart move to reduce hedging cost. 3m IVs are trending at a tad below 9.6%, while 1m IVs at 9.2%, this combination of IVs are conducive to construct diagonal spreads like options structures.

Thus, we advocate below option strategy to keep uncertainty in spot gold prices on the check.

Options strategy:

Risk-averse traders who are uncertain about trend directions, go long in XAUUSD 3M at the money -0.49 delta put, and go long 3M at the money +0.51 delta call and simultaneously, Short 1m (1%) out of the money puts. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

Alternative strategy: Initiated longs in CME gold for Dec’18 delivery at $1,352.80/oz in February 2018. Added an equivalent positions at $1,327/oz in March 2018 for a new entry level of $1,339.90/oz. Trade target is $1,540/oz with a stop at $1,273/oz.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty