The extrapolation of EURUSD levels of 1.24 indicates that the euro is seen as an attractive alternative to the US dollar by the market. But in this context let us refer to Thursday’s ECB meeting. Even if the trade-weighted euro has risen far less than EURUSD, concerns as to how ECB President Mario Draghi sees the recent EUR reaction is likely to keep EURUSD under control until Thursday. But here in this write up we’ve discussed on euro trades scenarios with other pairs as well, especially against Aussie trough H1’2019.

OTC Outlook and Options Strategy (EURUSD):

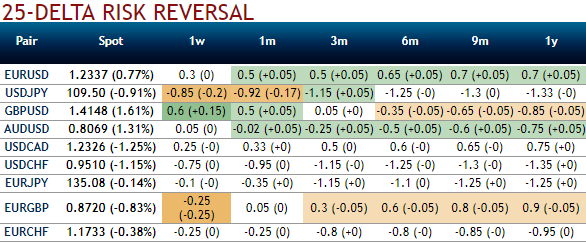

Please glance at the above nutshell showing IVs and risk reversals of this pair that has been indicating hedging sentiments for the bullish risks through this year. While implied volatilities have been extremely lower among the G7 FX space and you could also make out that there have been no hedging sentiments (1w tenors indicates bullish neutral hedging sentiments).

Well, contemplating these OTC indications, using reverse collar spread options strategy, the investor gets to earn a premium on writing overpriced puts, simultaneously add a protective at the money call option. Appreciate all benefits of underlying spot outrights moderately. If he’s having FX payables unless he is assigned an exercise notice on the written put and is obligated to buy outright holdings, this strategy is a risky venture. Shorting OTM puts fetches initial premiums that finances to purchase ITM calls.

Buying ITM call options gives you high positive delta, unlimited profit potential, and therefore if you are expecting EURUSD to spike up ascetically with the possibility of going much higher, you would buy ITM calls.

On the flip side, shorting OTM puts fetches you certain returns but limited profit potential as long as EURUSD remain above the strike price so if you are expecting the underlying pair to remain more or less sideways or upwards just a little bit, you would do this instead.

Currency Strength Index: FxWirePro's hourly EUR spot index is trending higher towards 58 levels (which is bullish) ahead of today’s ECB monetary policy meeting, while hourly USD spot index was at a tad below -138 (highly bearish) at the time of articulating (at 06:44 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices