Since we could foresee risk bias on both sides in NZDJPY as the long term downtrend seems intact and short term trend is just puzzling, the pair has recently started to drift higher and targets a break above 75.296 in near terms.

There’s plenty of Japanese event risk: Q1 GDP on Wed, Apr balance of payments the same day and on Thu, machinery orders. 3 months: As further BoJ easing looms, the cross may struggle to break below 73.

Technically, the pair has jumped above 7DMA levels and showing considerable price bounces s the momentum is confirmed by leading indicators, but the major bear trend remains intact.

In addition, the RBNZ’s MPS on Thu, while a close call, is expected to result in an on hold decision. If there is any sense the RBNZ may be reluctant to deliver the final rate cut in this easing cycle, then markets will buy NZD in response.

We continue to view the risks to the NZD outlook as being to the downside in the long run, but do not see an imminent catalyst, particularly with local data still robust.

That might well set off the next raft of unease as tensions between the real economy and financial markets flare.

Hence, in this baffling circumstance we’ve devised suitable option strategies for short-term speculation during higher IVs regimes.

Speculate the higher implied volatility of NZD/JPY

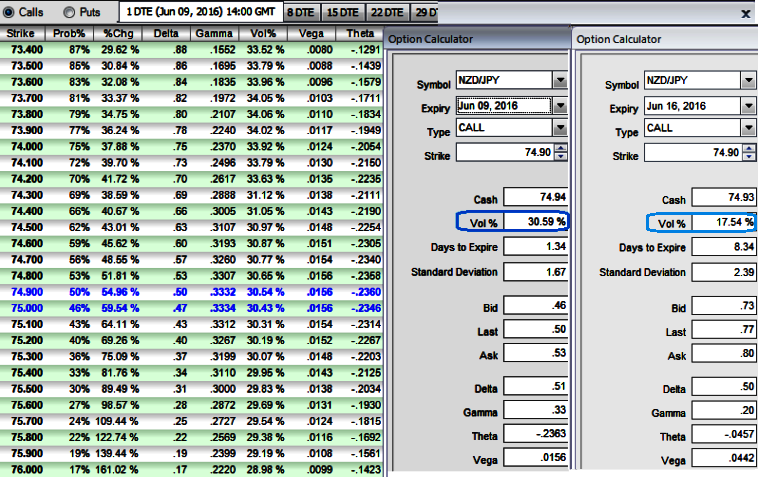

The current implied volatility of 1W NZD/JPY ATM call options are at 30.59%, and 17.54% for 1w expiries.

Spread ratio: (Long 1: Long 1)

Margin: No

Description: Use this strategy whenever IVs are spiking higher and during significant economic events are about to release, speculate the expectation of above mentioned higher volatility of 1D-1W expiries without taking a view on direction as short-term trend remains bullish biased (so favour calls and short put) and major trend is bearish (so use ATM puts to mitigate downside risks as well).

So, this is a strategy commonly used over clear non-directional trend and also during major economic announcements and events such as RBNZ’s OCR decision today.

Execution: Go long in NZD/USD 1W at the money +0.51 delta calls, and go long in 1W at the money -0.49 delta puts, simultaneously short 3D (1%) out of the money puts.

Profit: The profit increases as the underlying spot FX market rises, but hedges downside risks.

Loss: The maximum loss is the premium paid for the options.

Effect of Volatility: The value of both options will increase as volatility spikes and would decrease as volatility shrinks away.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?