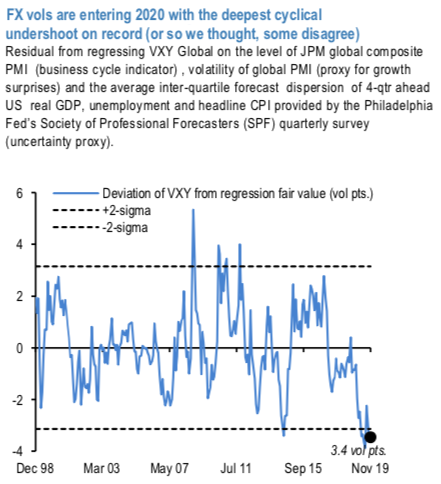

Mixed reception to the notion of FX vol being cheap: Whether it is due to a sunnier cyclical outlook for 2020, a more fundamental change in perceptions of fair value of volatility, or simple fatigue from fruitlessly spending premium to buy options in recent years, we encountered a surprising degree of disagreement around the (what we had thought is an open-and-shut) question of whether FX vol is at record levels of cheapness (refer above chart).

An element of conflating ‘vol is cheap’ with ‘buy vol’ may have been partly to blame; a few well-worn this-time is different arguments involving central bank puts were also trotted out by some accounts who recognize the valuation set-up but nonetheless appeared disinclined to bet on mean- reversion just yet.

A number of (ex-post) macro, structural and flow- related explanations have been advanced to explain the low-octane price action in FX vol. These include the dramatic rise in global central bank activism post-GFC to pre-empt left tail financial instability outcomes; increase in EM FX reserves as well shifts in reaction functions of some of them in the “manipulator report” era to curb vol-inducing FX weakness; the vol dampening impact of China’s management of its FX reserve portfolio to maintain a target currency composition since its transition to a basket-based currency regime in late-2015; entrance of new vol-selling actors (real money) into the option market in recent years starved of traditional carry income in negative /zero /at effective lower bound policy rate regimes; and the anchoring effect of reserve diversification (Euro buying) and institutional flows (Japanese selling of Yen) in suppressing left tails in G3 FX. Many investors have cited the sluggishness of the Euro and the Yen in particular as an important drag, arguing that it is difficult for currencies as an asset class to pick up a meaningful head of steam when the two largest volume turnover engines are effectively parked in the shed.

All of these have some merit, and together paint a picture of a market wherein normal higher frequency boom/bust cycles of risk appetite have been dampened by a mix of hyperactive policy support and flows betting on the continuation of the same.

3M EURUSD-volatility would hardly be stuck around the 5% mark. If one ignores GBP volatility though the FX market has returned to the vol lows seen last summer. The hopes are lingering that the vol levels seen at the time would be short-lived was correct in the sense that volatilities rose significantly in August. However, there is no sustainable escape from the structural low volatility environment - that much has become clear.

Contemplating the major trend that has been range-bounded (oscillating between 114.731 and 104.464 levels), and low IVs (implied vols) environment, it is wise to deploy strangle short strategy. USDJPY displays the least IVs for 1m tenors among the G7 FX-bloc (refer 2nd chart) and the low vol regime is most likely to persist on the eve of festive season.

However, there is no sustainable escape from the structural low volatility environment - that much has become clear. That is seemingly positive for all those for whom FX is an undesirable risk. Courtesy: JPM

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?