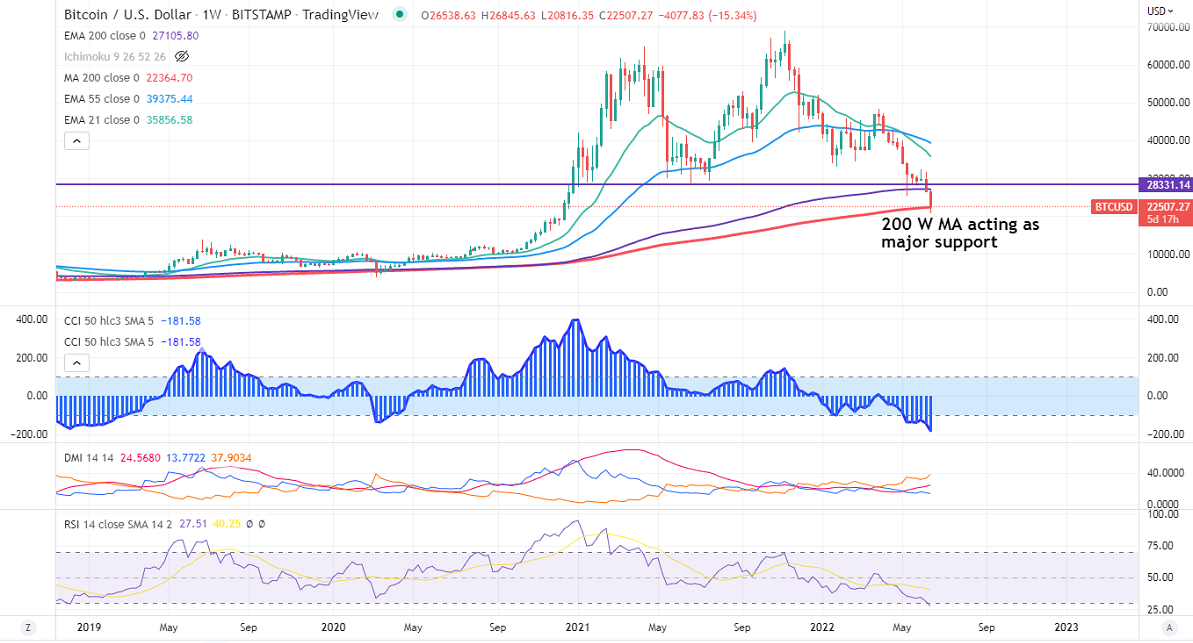

BTCUSD continues to trade weak and hits an 18-month low at $20816. It is currently trading around $22254.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (highly positive correlation with BTC)- Bearish (negative for BTC). The index holding below 2000-W EMA. Any close below 10775 (200-W MA) will drag NASDAQ to 10520/10000.

US bond yields (Bullish)- Negative for BTC. US 10-year yield surged sharply, hitting the highest level since 2018 on rising inflation. Markets eye US Fed monetary policy tomorrow for further direction.

Crypto News-

Celsius network negative news also dragged crypto down further. The largest crypto lenders have paused all withdrawals and transfers due to extreme market conditions.

Technicals-

Major support- $22284 (200- W MA). Any weekly close will bring an end to the bullish trend, a dip to $15000/$10000 is possible.

In the weekly chart RSI (14)- 27.67 (Oversold). Any decline can be used as an opportunity to buy.

Bull case-

Primary supply zone -$23850. The breach above confirms minor bullishness. A jump to the next level of $24850/$25400/$27000 is possible.

Secondary barrier- $32500. A violation above that barrier targets $37000/$40000.

It is good to buy on dips around $20000 with SL around $17000 for TP of $30000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary