The journey from $751.34 to a whopping $17,270 (at BITSTAMP exchange), or 2,199% in this year so far with a fortnight trading spare:

Bitcoin has held steady for the last couple of trading sessions, it is stuck in the range between 15400 and 14628 levels but more bearish potential for the day.

December was an eventful month for bitcoin, with investors for the first time being able to access bitcoin indirectly through futures and options made available through CME and CBOE.

BTCUSD surged to almost a mammoth 195% in last month. But please be mindful of the price oscillation, price tumbles from the peaks of $19,697 to the lows $11,159, bounced back again to $16,480, but couldn’t sustain, consequently, we could see slumps back again to $12,050 levels before the climb over to $15,550 mark.

Amid this price developments, hedge fund flows have poured in cryptocurrencies that have had an average return of 1,522% this year, compared to an average of 7.2% for hedge funds invested in conventional assets classes.

Newly invented blockchain technologies have attracted investor interest in funds and cryptocurrencies have surged in recent months as these innovations continue to move towards the mainstream and generate compelling opportunities for investors, portfolio managers, traders and other market participants.

The HFs note to investors points out that in 2017, cryptocurrency markets and trading platforms have come up with better liquidity and stability, as additional products have been added in an attempt to tame the volatility of Bitcoin.

Volatility is the heart and soul of options trading. With the proper understanding of volatility and how it affects your options, you can profit in any market condition. The markets and individual asset class are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our options strategies.

When we talk about volatility we are referring to implied volatility. Implied volatility is forward-looking and shows the “implied” movement in an underlying asset’s future volatility.

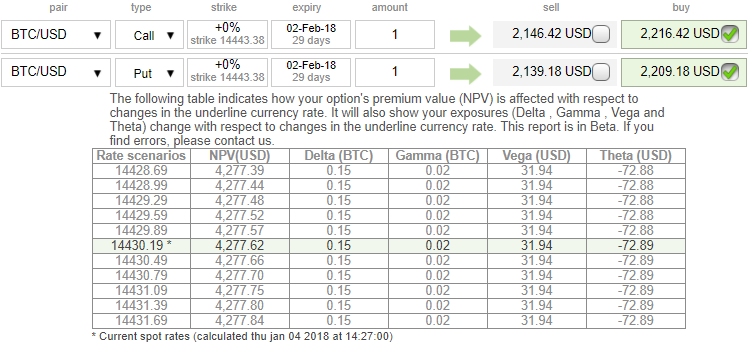

Hence, to keep these volatilities on the check, we advocate options strategies as shown in the above diagram (ORE offers customized options strategies on BTCUSD):

Strategy overview: Investor reckons that the BTC price action would be highly volatile like before.

The execution: On hedging grounds, buy 1m at the money call and at the money put of the similar expiry.

Profit potential: Unlimited after BEP.

Risk profiling: Limited the extent of initial premiums paid.

Margin: No margin needed.

Keep in mind: Position likely to lose its value with the passage of time as the TVM decreases.

Alternatively, on trading grounds, one can deploy strangle shorting by selling (1%) OTM call and (1%) OTM put for the net credit.

This strategy is suitable when trader thinks that the market won’t be volatile and broadest range bounded. Please be noted that the margin is required on short options, where returns would be limited exposing to unlimited risks.

Currency Strength Index: FxWirePro's hourly BTC spot index is displaying shy above 10 levels (which is neutral). While hourly USD spot index was inching towards -36 (bearish) while articulating (at 09:03 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?