Gold prices lost their shine on rising US treasury yields. Gold recently dropped to a multi-month low of $2,590 but is now around $2,593.90.

Key Factors Driving Up U.S. Treasury Yields

The recent increase in U.S. Treasury yields is due to several important factors. First, strong economic data, especially a jobs report showing a gain of 254,000 nonfarm jobs in September, has made investors rethink the economy's strength and the Federal Reserve's future actions. Second, after this good news, market expectations for interest rate policies have changed, with a 91% chance of a 0.25 percentage point rate cut at the Fed's meeting in November, affecting yields. Lastly, concerns about rising inflation have also contributed to the increase in yields, as investors are unsure how the Fed will respond to inflation with a strong job market. Overall, these factors have created upward pressure on Treasury yields.

Sell-Off Warnings from BlackRock and JPMorgan

Bloomberg reports that hedge fund Blackrock and investment bank JPMorgan are warning about a potential major sell-off in U.S. bonds. A key reason for this concern is the rising Treasury yields, with the 10-year yield nearing 4.50%. Higher yields indicate that investors want more return for holding bonds, which can cause bond prices to drop. Additionally, strong economic data, especially from the labor market, has led to expectations that the Federal Reserve may keep raising interest rates. This speculation about more rate hikes puts added pressure on bond prices. Overall, investors are worried about how these factors will affect the bond market.

According to the CME Fed watch tool, the probability of a 25 basis points rate cut in December decreased to 68.80% from 77.30% a week ago.

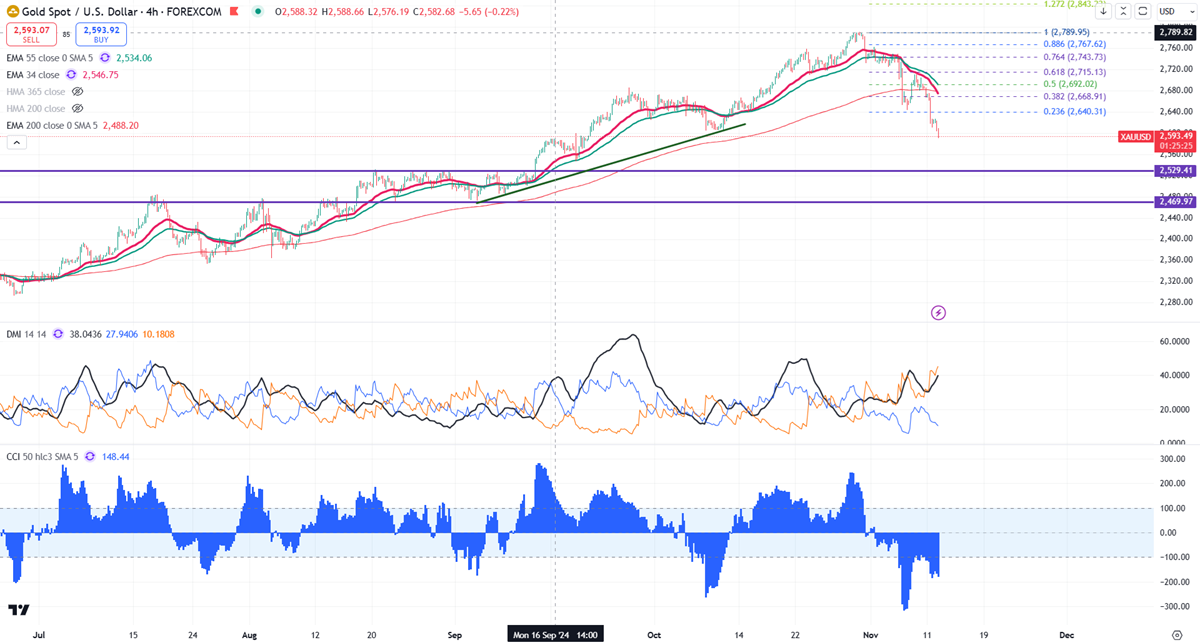

Gold remains below both short-term and long-term moving averages on the 4-hour chart. The immediate support level is around $2,580; a fall below this could lead to targets of $2540/$2500/$2470. A bearish trend would only be confirmed if prices drop below $2,470. On the upper side, minor resistance is found at $2,620, and breaking past this barrier could push prices up to $2635/$2665/$2700.

Current market indicators present a bearish outlook: the Commodity Channel Index (CCI) indicates a bearish trend, while the Average Directional Movement Index (ADX) suggests a neutral outlook.

Consider making sell on rallies around the 2,618-20 mark, with a stop-loss positioned around 2,650 and a target price of $2,540/$2475.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings