In this write-up, contemplating monetary policy outlook and geopolitical surface, we refer to JP Morgan’s analytical piece and emphasize on the long vega exposure - 6M6M/+1Y6M FVA 1*2 spreads for hedging the simmering broad-based risk sentiments.

BoC maintains status quo in yesterday’s monetary policy, left the key interest rates unchanged at 1.75%.

Their reaction function, especially relative to the Fed, will likely remain one of the biggest uncertainties around CAD’s relative performance. CAD 2y OIS has declined 11bps in the past month, and now is pricing in up to three cuts by end-2020, starting in December. Our economists are forecasting the BoC to deliver insurance cuts in Oct and Dec, although uncertainty around this is higher for BoC than perhaps elsewhere where central bank rate cuts are being priced in.

While the US-China trade developments remain very fluid and we are bound to see a few more adverse episodes.

The Cheap vega ownership could be deployed in anticipation of the vega tenors receiving more attention with the spot now under the watchful PBoC hand, we recommend using the favorable vol entry levels to add vega.

Utilizing attractive pricing and positive rolldown, 1x2 FVA spreads are time passage friendly and low maintenance long vega positions that struck us as a solid buy in the current environment where low decay vega is well sought after. The basic construct involves selling shorter-dated FVA along upward sloping segment of the vol curve to partially fund the purchase of a longer-dated FVA that sits on a flatter part of the term structure. The roll-down of the short leg then compensates (or even eliminates, as is the case for CADJPY) the slide of the long position, all the while preserving the overall structure’s net long vol characteristic. The short leg is not large enough to disrupt the net positive sensitivity of the package to vol upturns. Consequently, the structure is a carry efficient risk-off hedge.

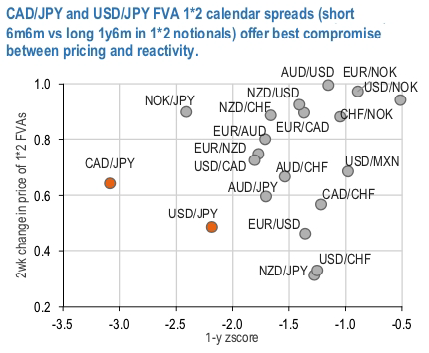

We screen for the FVA spread candidates based on their pricing (in form of a 1-y z-score) and the sensitivity to the ongoing market turbulence (in form of 2-week change in pricing of the package) (refer 1st chart).

In the case of CADJPY, the current levels are still a bargain by historical standards, even after the recent bounce. The net 6-month static vol slide (at the expiry of the short leg) deteriorated as the front vols spiked on the back of the recent spot gyrations but is still positive thus making the long/short structure superior to holding a similar long-dated straddle (refer 2nd chart).

Consider: short 6M6M CAD/JPY @8.7ch vs long 1Y6M @8.55/9.05, in 1:2 vega weights or short 6M6M USDJPY @7.6ch vs 1Y6M @7.55/7.95 indic, in 1:2 vega weights. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data