Over the weekend, the Bank of Canada cut its key interest rate by another 50 bp, after it had lowered its key interest rate from 1.75% to 1.25% at its regular meeting. The BoC also said that it was ready to take further steps if necessary.

Not only does the impact of the covid-19 pandemic pose significant downside risks to the Canadian economy, but also the sharp drop in oil prices is likely to weigh on the Canadian economy. The coronavirus has not yet spread so strongly in Canada. But experience shows that this can change quickly. The pandemic is certainly noticeable. Tourism, retail, restaurants, entertainment: There are already significant cutbacks. Now the border is also being closed.

In view of the high level of uncertainty, it is therefore understandable that the central bank has confirmed its willingness to act if necessary. At the moment, it looks as if this will actually become necessary, so we expect a further interest rate cut at the latest at the regular meeting on April 15. The CAD should therefore remain under depreciation pressure and USDCAD should remain above 1.40.

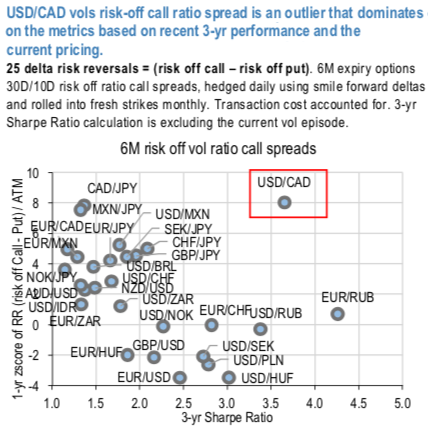

While the market sentiment has been driving strictly defensive positioning we think that it is prudent to keep an eye on historic skew dislocations their theta-scalping via risk off ratio spreads (delta-hedged). Those are a class of structures that can efficiently monetize excessive risk premia in vol smiles. While ratios can be struck for both calls and puts, the recent vol episode pushed the pricing of risk of OTM strikes into uncharted territory and made of particular interest the structures where the short notional is placed on the “risk-off” side, i.e. selling risk-reversals. While such structures are quicker in collecting premium, exposure to left tail is notable.

USDCAD vols risk-off call ratio spread is an outlier that dominates (refer above chart) where currency pairs are screened based on 3 year Sharpe (a medium term performance horizon) of risk off ratio vol spread structures and 1-y zscore of skew / ATM vol ratio.

3M USDCAD delta-hedged ATM/25D call spread @9.8/10.3indic vs 12.7ch, equal notionals to keep the structure net long vega. Courtesy: JPM & Commerzbank

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms