Brexit negotiators pick up the pace to avoid ‘no deal’ as key Autumn deadlines rapidly approach. After their meeting on Tuesday UK Brexit Secretary Dominic Raab and EU chief negotiator Michel Barnier announced that with some key autumn deadlines fast approaching, negotiations will now be ongoing. Mr Raab and Mr Barnier will probably meet again next Tuesday.

Meanwhile, on Thursday the Brexit Secretary claimed that it was “unlikely” that the UK would leave the EU without a deal. Despite this, the government published around 27 ‘technical’ papers on the consequences of a ‘no deal’ outcome, with more to come. Parliament reconvenes on 4thSeptember and the trade bill is set to be discussed in the House of Lords on 11thSeptember.

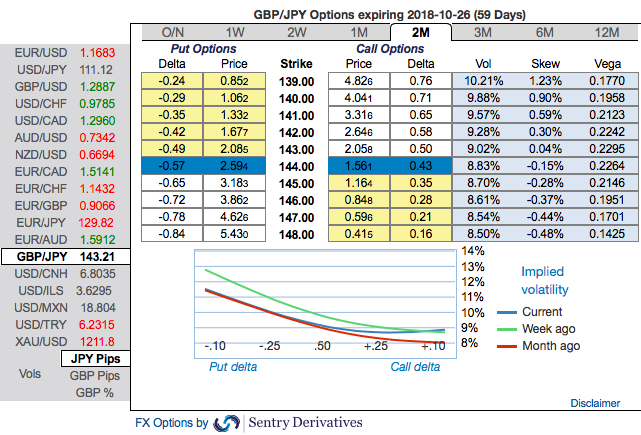

GBPJPY has consistently been dipping from the recent peaks of 147.148 levels to the current 143.277 levels while articulating (at 08:08 GMT). We’ve explicitly highlighted further bearish potential of this pair in the days to come in our technical section, please follow below weblink for more reading on the same:

Fundamentally, as we continue to foresee the trade apprehensions ratchet up, the GBPJPY likely to prolong its bearish streaks amid minor spikes against the Japanese yen in a typical “risk off” move. These bearish sentiments are factored-in OTC markets.

The market sentiment seems to flip flop back and forth on a daily basis between a “Risk On” and a “Risk Off”. Reading Risk Sentiment is as simple as following the direction of the US Stock Market.

Each day, it seems a new rumor is produced and the stock markets shifts accordingly. The seesaw action can take a toll on a trader’s emotions.

OTC outlook and Hedging Strategy: Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 139 levels (refer above nutshell evidencing IV skews).

Accordingly, put ratio back spreads couple of days ago were advocated, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on any abrupt momentary price rallies and bidding theta shorts in short run, on the flip side, 2m skews to optimally utilize delta longs.

The execution: At spot reference: 143.25, short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options. A move towards the ITM territory increases the Vega, Gamma and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair.

The fresh delta longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy by reducing the cost of hedging. Thereby, the above positions address both upswings in short run and bearish risks in long run by delta longs.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -36 levels (which is bearish), while hourly JPY spot index was at -96 (bearish) while articulating (at 08:08 GMT). For more details on the index, please refer below weblink:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise