Gold’s rallies have been eventful trading sessions in the recent past to wrap-up 2018 (almost over 4.77% spike in the last month), gold price in the major trend has gone into the consolidation phase.

Technically, the major trend resume consolidation phase after the formation of hammer patterns at the double top neckline (refer monthly plotting). As a result, the current price on this timeframe, has spiked above EMAs with most likely bullish crossover. Both RSI and stochastic curves, also converge upwards to the upswings.

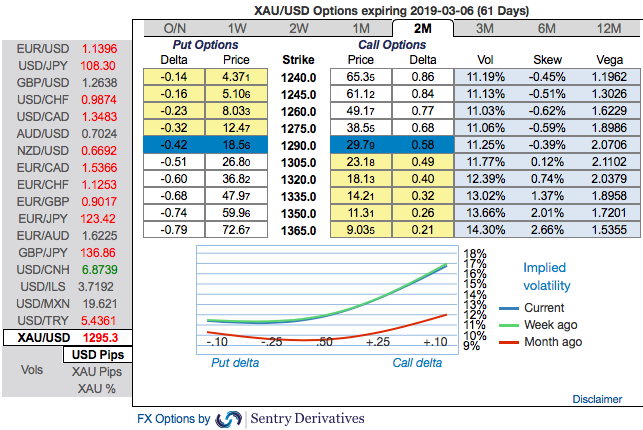

Bullish neutral risk reversals are observed in gold’s OTC hedging market, while positively skewed IVs of 2m XAUUSD options have been stretched out on either side.

This is interpreted as the mounting hedgers’ bids for OTM calls options.

Well, on hedging grounds, keeping topsy-turvy underlying sentiment under consideration, XAUSUD ATM straddles are advocated, while the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 1m tenors at net debit with a view of arresting potential FX risks on either side.

On trading perspective, bidding bullish neutral risk reversals, buying (1%) in the money gold call options are advocated, an in the money call with a very strong delta would move in tandem with the underlying XAUUSD move.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 37 levels (which is bullish), while articulating (at 05:38 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data