The escalation of US-China trade tensions has been a key driver behind the rising volatility in the metals complex. As global trade tensions heat up, the potential impact could be two-fold.

On one side, our forecast of above-trend global growth is being increasingly challenged as an escalation in global trade tensions will bring with it significant supply shock to the world economy, rising inflation and lowering growth.

The indirect effect of trade wars is the loss of confidence, resulting in corporate and household retrenchment that eventually leads to the generalized tightening in financial conditions; we particularly see the start window for an intermediate Precious Metals rally open.

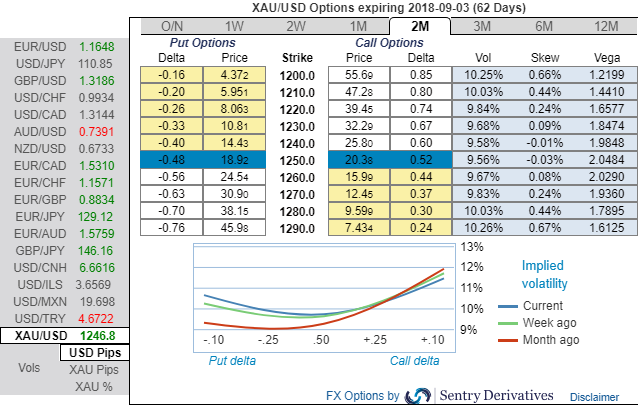

While 2m IV skews of gold (XAUUSD) options have been well balanced on either side and signify the hedgers’ interests on both OTM call and put strikes. While the combination of 1m bearish neutral remains intact with shrinking IVs is conducive for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

While it is reckoned that as per the OTC indications as shown above and the prevailing trend in bullion markets seem to be reasonably addressed by hedging participants, thus, we advocate below option strategy to keep uncertainty in spot gold prices on the check. On trading perspective also, the strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on the downside and with cost-effectiveness.

While the risk-averse traders who are dubious about upside move, accordingly, initiate longs in XAUUSD 2M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2w (1%) out of the money calls. Thereby, we favour bulls as we foresee more upside risks by keeping longer tenors on call leg.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -30 levels (which is bearish), while articulating at (13:16 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data