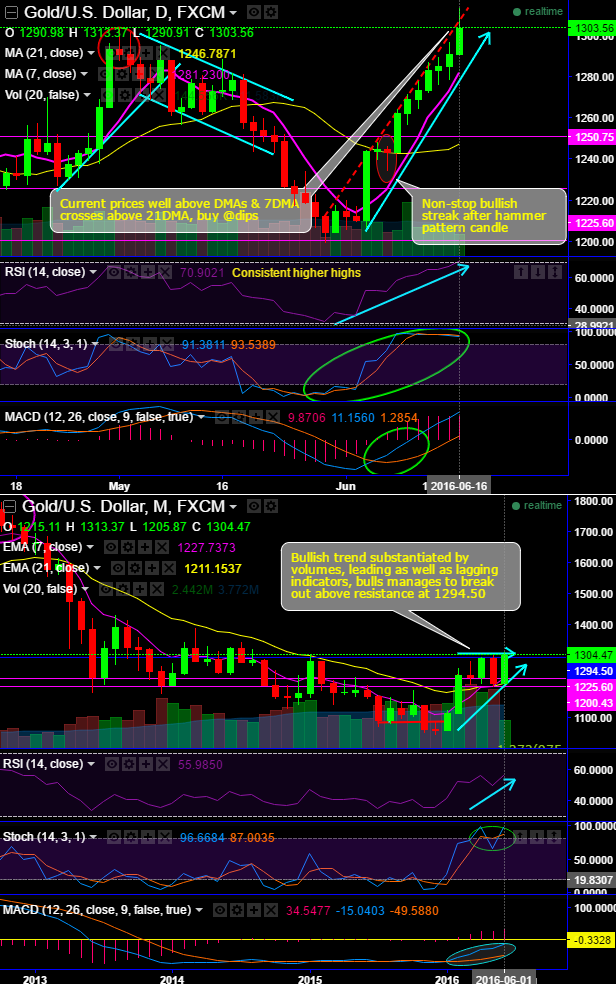

Technical Inference:

We urged for gold’s resurgence on 8th (i.e exactly a week ago), that is when you could spot out a hammer pattern candle at 1243.54 levels.

For more reading on our previous call, please go through below web-link:

Well, for now, the yellow metal hits 22months highs at 1313.37 levels, dropping back to halt at the current 1303.46 levels.

While the current prices have maintained still well above DMAs to signal a more bullish environment.

Especially after last night, FOMC members’ dovish hints on Federal Reserve deferral of speculated rate hikes, this precious metal has been very susceptible to moves in U.S. interest rates.

RSI has been clearly converging to the prevailing rallies ever since it has dropped and tested supports at 1200 levels, no deviation at all, currently approaching overbought zones but no signals to harm in buying sentiments.

Stochastic curves have reached overbought territory on daily but no clear %D crossover.

Usually, a gradual path to higher rates is seen as less of a threat to gold prices than a swift series of increases.

On a broader perspective the precious metal has broken 17-months today (at 1294.41) (see monthly charts).

Leading oscillators on monthly plotting have been conducive to these bullish sentiments, after the breach of resistance at 1294.50.

MACD’s after long-lasting halt in bearish trajectory has signalled trend reversal likely to prolong

To conclude, “Never buck the trend” is what we could advocate to be precise.

Trade tips:

In a medium term perspective traders, the previous long positions in the gold's mid-month futures can be maintained further for an unlimited return and fresh long build ups can also be initiated on every dip that could be entered to profit from a rise in the price of the underlying precious metal ahead of uncertain Brexit events the investors consider this commodity space as safe haven for investments.