Bearish sterling scenarios:

1) UK growth stay nears 1.5%.

2) CPI peaks and wage growth fails to accelerate to 3%;

3) The balance of payments pressure (capital repatriation from LT investors; current a/c stuck at 4-5%). 4) PM May faces a Conservative leadership challenge.

Bullish sterling scenarios:

1) The economy rebounds to 2% on stronger export demand and the curve prices 2 hikes by end-18. 2) The EU softens its stance towards a FTA that incorporates services.

Bullish AUD scenarios:

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labour market;

2) China data weaken materially; or

4) The risk markets retrace and vol rises as financial conditions tighten.

Bearish AUD scenarios:

1) China eases policy and commodities rebound;

2) The Fed’s tightening timeline is severely disrupted by further downside surprises on inflation; or

3) The RBA adopts a more hawkish tone to its communications.

Hedging strategy:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

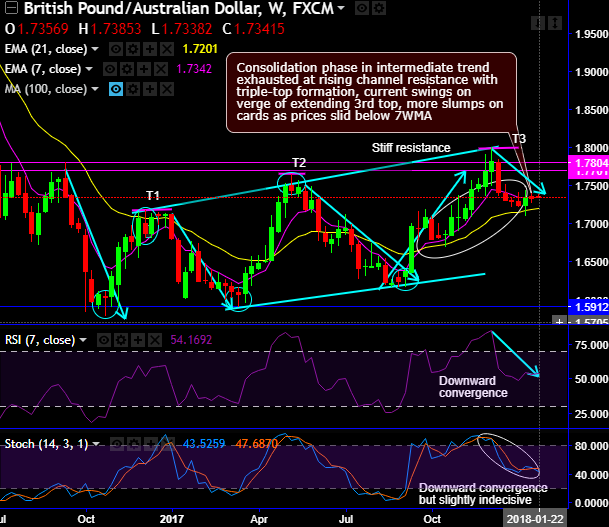

The execution: Initiate long in GBPAUD 3M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 1m (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: Please be noted that 3m skews are stretched on either side, ATM options have more likelihood to expire in the money and the 1m IVs are just shy above 8.12%, whereas 1% OTM calls of this tenor seem to have been overpriced at 18.75% more than NPV, hence, we foresee writing such exorbitant calls amid bearish pressures are beneficial as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed