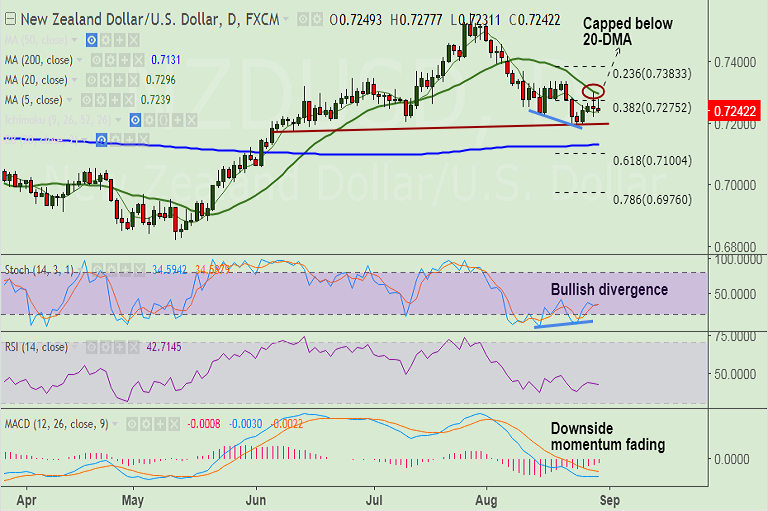

- NZD/USD holds above 5-DMA support, trades largely unchanged at 0.7244 at the time of writing.

- Bullish divergence on Stochastic keeps scope for upside in the pair.

- 20-DMA is major resistance on the upside, break above could see further gains.

- Break below 5-DMA support finds next major support at 0.72 (trendline).

- Technical studies are bearish. We see scope for test of 100-DMA at 0.7180 on break below 0.72 handle.

- Technical studies on weekly charts are also bearish. RSI and Stochs are biased lower, MACD is no verge of bearish crossover on signal line.

- Break below 100-DMA at 0.7180 could see drag till 0.71 levels (61.8% Fib retrace of 0.68176 to 0.7558 rally).

Support levels - 0.7240 (5-DMA), 0.72, 0.7180 (100-DMA), 0.7131 (200-DMA)

Resistance levels - 0.7275 (38.2% Fib), 0.7295 (20-DMA), 0.7329 (50-DMA)

Recommendation: Watch out for break above 20-DMA for upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -39.1374 (Neutral), while Hourly USD Spot Index was at -67.1225 (Neutral) at 1010 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest