The price of precious yellow metal (in the bullion market) gains considerably from the last couple of days, currently, exhausted at $1,747 and oscillating between $1,700 and $1,728 levels.

Multi-week slowdowns in COVID-19 infection rates and fatalities are adding to the broadest,

largest and earliest monetary/fiscal stimulus programs in history.

As Covid-19 started to invoke fears of a dollar liquidity crunch, gold became a ripe candidate for a selloff. The need for dollars from both within and outside the finance sector arose. Heavily stressed sectors like airlines and hospitality reportedly sought to draw down credit lines as they tried to maintain operations. The finance industry, whipped by volatility, margin calls and financing needs, also started to demand more dollars.

Hence, Gold became a prime target for a selloff if not in long run at least momentarily. As gold was a highly liquid asset and was one of the few markets still posting year-to-date gains, investors reportedly sold off gold to raise cash.

To begin this week, the price gains have been pared with profit booking sentiments. There were traces that investors remain highly cautious amid the prevailing pandemic circumstance.

Gold prices surged to their highest level in more than seven years as the spectre of a deepening global recession continues to support safe haven buying. Spreads between futures and spot prices also remain wide, suggesting liquidity remains tight. The latest wave of buying was sparked by the announcement last week that the Fed will invest up to USD2.3trn in loans to aid small and medium sized business.

OTC Updates:

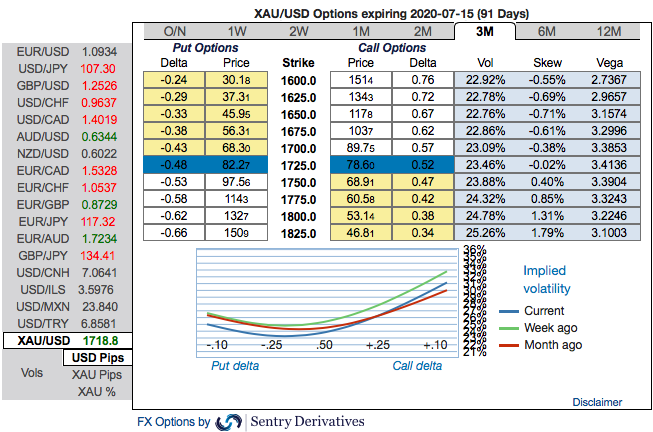

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,825 is quite evident that reminds us hedgers’ inclination for the upside risks.

One could also see the fresh positive bids for the existing bullish risk reversal setup. To substantiate the above-mentioned bullish sentiment, risk reversal (RRs) numbers also indicate the overall bullish environment (2nd nutshell). Well, we know that options are predominantly meant for hedging a probable risk event in future.

Hedging Strategies:

Capitalizing on all the above fundamental drivers and OTC indications, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying. Courtesy: Sentry & Saxobank

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close