The gold price has constantly been dragging the rallies above 7DMA from February month series (refer daily charts) ever since it tested the strong support at 1179 levels on daily plotting to the current 1233 levels (refer weekly plotting).

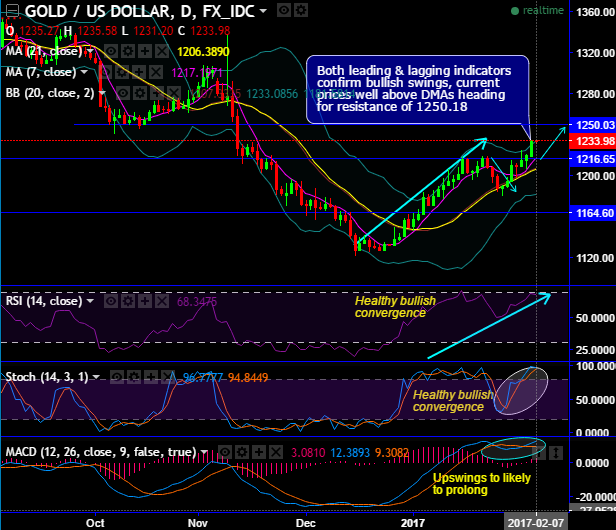

Both leading & lagging indicators confirm bullish swings, current prices well above DMAs heading for the resistance of 1250.18.

We see upside traction for gold prices even on daily and monthly plotting as both leading & lagging indicators confirm bullish swings, the current prices remain consistently well above 7DMAs sensing the buying interests.

As the bulls break major resistance at 1213 marks (i.e. 50% fibos) and the current price spike above 7EMA with bullish momentum, we could foresee more rallies on cards up to $1250 mark.

Can bull swings hit 61.8% fib.ret after the breach of 50% Ret.? Spikes above 21SMA with bullish momentum may head for $1250.

The stochastic oscillator on dailies has reached overbought region but no traces of %d crossover and this leading oscillator on monthly term has been popping up with buying pressures as it has shown a clear %k crossover at around 40 region.

While RSI also evidences healthy bullish convergence on both timeframes that indicates the strength in the ongoing uptrend.

Hence, we foresee further upside movements up to 1250 that seems to be very much on cards but bull swings may go little flat as it senses struggle to break this significant resistance level.

Trade tips:

Contemplating above technical reasoning, as both stochastic and RSI noise with strong momentum in buying interests as they are converging to the ongoing upswings, we advocate long hedge which is the strategy to lock in the price of a product or commodity to be purchased sometime in the future. Hence, the long hedge is also known as input hedge.

So, stay long via futures contracts of near month futures of gold, Should the underlying commodity price rise, the gain in the value of the long futures position would be able to offset the increase in purchasing costs.