Yesterday, GBP against USD and EUR reached highs of 1.3047 and 0.8655 levels, respectively, owing to the news of a Brexit deal between negotiators. The former fell back to 1.2950 and is currently trading around the 1.30 mark.

Well, let’s quickly take a glance at some key fundamentals: The UK Cabinet is expected to meet today at 14:00 GMT to consider the draft withdrawal agreement and the outline of a future relationship, which was reached between EU and UK negotiators yesterday.

Allegedly the Brexit negotiations with Brussels continued in the recent past also. A deal is said to be found and we are told so that it can be signed at a special EU summit before the end of the month. But even Prime Minister Theresa May referred to the remaining issues as being extremely difficult. There were “significant” differences still to be overcome. That illustrates once again: until everything has been agreed, nothing has been agreed. Even if an agreement with Brussels is reached, things are not over yet. Resistance is mounting in Theresa May’s own cabinet against what she might agree on.

The two favorable developments as discussed indicate that we are now moving into the next phase of negotiations which would be somewhat GBP-positive in the near term (we expect 2-4% of upside on the crosses). This might appear as only modest upside but additional upside will likely be capped by multiple factors.

Primarily, even if an EU-UK deal is reached, the path to securing Parliamentary support will likely be tenuous (multiple attempts will be likely be necessary which will likely be a source of headline risk/ greater volatility).

Secondly, even though the news on financial services is positive, the devil will be in the details that will only be known subsequently.

And finally, beyond the withdrawal agreement, the new trade agreements still need to be reach which will be a multi- year process leaving the Brexit-related uncertainty overhang intact and thus limiting substantial GBP upside.

As we continue to foresee the trade apprehensions ratchet up, the GBPUSD likely to prolong its apprehensions amid minor spikes in a typical “risk off” move.

On the flip side, the US dollar has risen over the past week, helped by strong data and bullish comments from Fed Chairman Powell. Today’s focus will be on US payrolls and earnings figures. Both the ADP and ISM reports point to a potentially strong outturn.

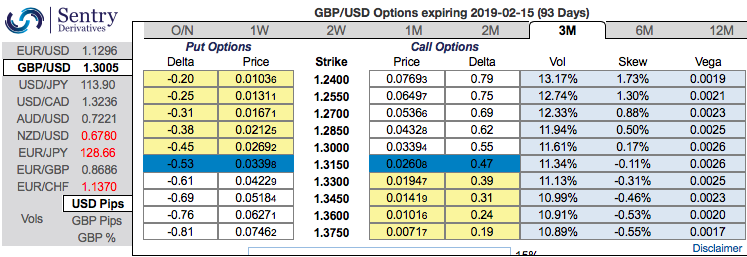

All the above considerable driving forces appear to be factored in GBP OTC option markets:

Positively skewed GBPUSD implied volatilities of 3m tenors still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been in negative territory.

We reiterate that the sterling should not suffer like before, but, one should not disregard Fed’s hiking cycle on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs. Courtesy: Sentrix, Saxo

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 5 levels (which is neutral), and hourly USD spot index has bearish index is creeping at 25 (mildly bullish) while articulating (at 08:53 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts