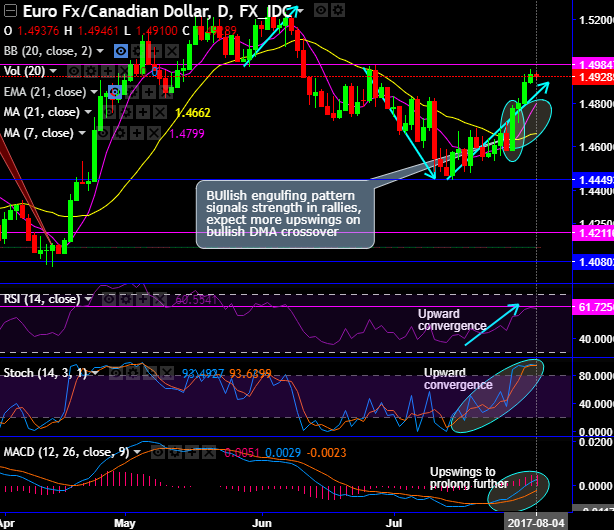

Although today’s trend seems to be little edgy as it is heading towards a stiff resistance at 1.4984 levels. But bullish sentiments have been robust on healthy major uptrend amid minor hic-ups.

You could very well observe the bullish engulfing pattern has occurred at 1.4779 levels. As a result, you could also figure out the bullish effects thereafter. The current prices have gone well beyond 7DMAs.

This bullish pattern candle still signals the strength in rallies; for now one can expect more upswings on bullish DMA crossover (7DMA crosses above 21DMA).

On a broader perspective, the major trend has been spiking through rising channel. One could see as and when the prices touched channel base, the hammer patterns have evidenced stern bounce backs.

In the recent past, the Dragonfly doji popped up exactly at channel support (1.4066), consequently, we’ve seen its bullish functionality.

This is yet again bullish pattern to evidence spikes above EMAs, for now, the uptrend likely to prolong on both leading & lagging indications.

Both RSI on both daily as well as monthly charts shows upward convergence to the price rallies. While stochastic curves have been little indecisive at and near overbought territory (on daily and monthly charts) but the bullish favor.

Lagging indicators have been absolutely signaling the extension of the bullish trend. 7DMA crosses above 21DMA which is the bullish indication, while same has been the case on EMAs on monthly terms.

To substantiate this buying sentiment, MACD also indicates upswings to prolong further on both time frames. Overall, both minor and major trends have been bullish; hence, accumulate rallies on every dip perceiving them as a buying opportunity unless a dramatic signal arises.

When the research is so certain, one can capitalize on buzzing rallies that lure levered instruments such as one touch binary call options through which the successful trade results can fetch you magnified and exponential yields than spot FX. Hence, buy one touch binary call option on every dip, as the underlying spot FX keeps rising, one can be rested assured with 8-10x returns.

Currency Strength Index: FxWirePro's hourly EUR spot index has turned into 139 (which is extremely bullish), while hourly CAD spot index was at -121 (extremely bearish) at 12:06 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings