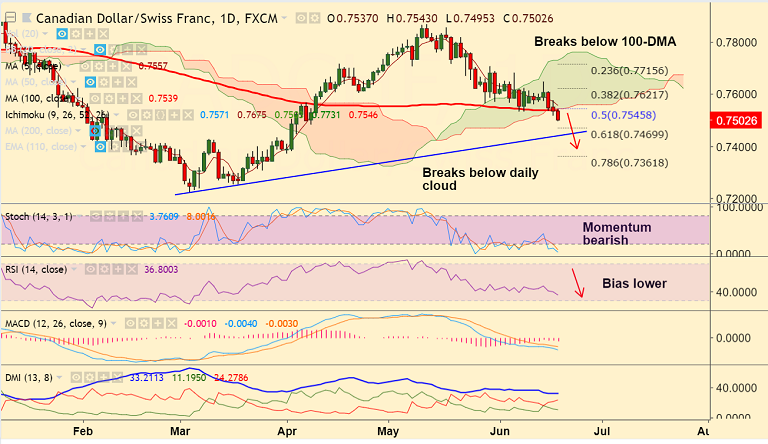

- CAD/CHF is trading 0.41% lower on the day, at 0.7506 at the time of writing.

- The pair trades with a bearish momentum and break below daily cloud has raised scope for further downside.

- RSI and Stochs are biased lower and MACD is well below zero levels. We see -ve DMI dominance which support weakness in the pair.

- Price action has broken below 100-DMA and upside remains capped at 5-DMA.

- Next major bear target lies at 61.8% Fib at 0.7470. Break below to see further weakness.

- On the flipside, retrace above 100-DMA could see minor upside. Bearish invalidation only above daily cloud.

Support levels - 0.7470 (61.8% Fib), 0.7445 (trendline), 0.74, 0.7361 (78.6% Fib)

Resistance levels - 0.7521 (1H 21-EMA), 0.7539 (100-DMA), 0.7557 (5-DMA)

Recommendation: Good to go short on rallies around 0.7510/20, SL: 0.7560, TP: 0.7470/ 0.7445/ 0.74.

FxWirePro Currency Strength Index: FxWirePro's Hourly CAD Spot Index was at -113.829 (Bearish), while Hourly CHF Spot Index was at 76.1385 (Neutral) at 0745 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.