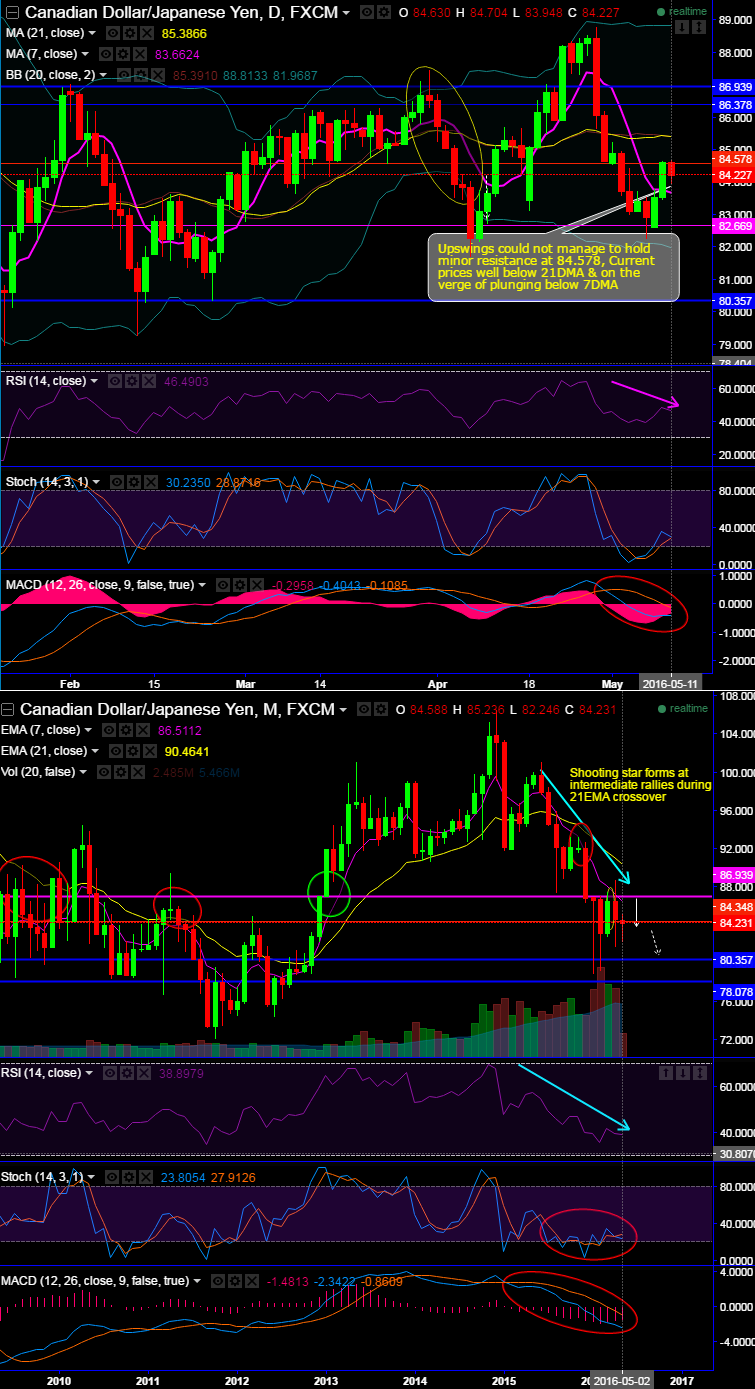

Upswings could not manage to hold minor resistance at 84.578, Current prices well below 21DMA & on the verge of plunging below 7DMA.

We could now foresee further weakness in CADJPY when we consider the intermediate and long term trend of this pair.

Bearish appearances as it has failed to even extend upto minor resistance at 86.939 levels (see for the price behaviour at that level in the recent history, that is where it has been sensing stiff resistance from last couple of months).

In addition to that, even if the price on daily terms has managed to bounce from the lows of 82.669 it hasn’t been able to break out and sustain 84.578 levels.

The leading indicators on daily are puzzling the recent upswings but on monthly terms it is indicative of strong momentum in price dips that signals strength in major downtrend.

The price on monthly drop below 86.939 and 84.348 decisively has been serving strong bear trend with robust volumes.

Most notably, 21EMA has crossed over 7EMA, hence, trend is likely to persist. When 21EMA crossover a “Shooting star” pattern forms at intermediate rallies.

Monthly RSI has convincingly converging with price declines near 40 levels (Currently, RSI trending below 39 levels).

But slow stochastic is stating indecisiveness but slightly bearish bias as we observed no clear traces of %K crossover at 20 levels on monthly terms that would mean buying pressure is yet generate at this point of time.

MACD on both daily and monthly terms suggests bear trend continuation.

Contemplating intraday bearish sentiments, we recommend on pure speculation basis buying one touch binary puts in order to extract maximum leverage for extended profitability, for targets at 83.901 with SL at 84.578 levels. But in medium terms we could even foresee spot targets at 84.348 and below.

One can give leveraging touch to your returns expectation if underlying pair keeps dipping by employing At-The-Money binary delta puts. But do remember these are exclusively for speculative basis.