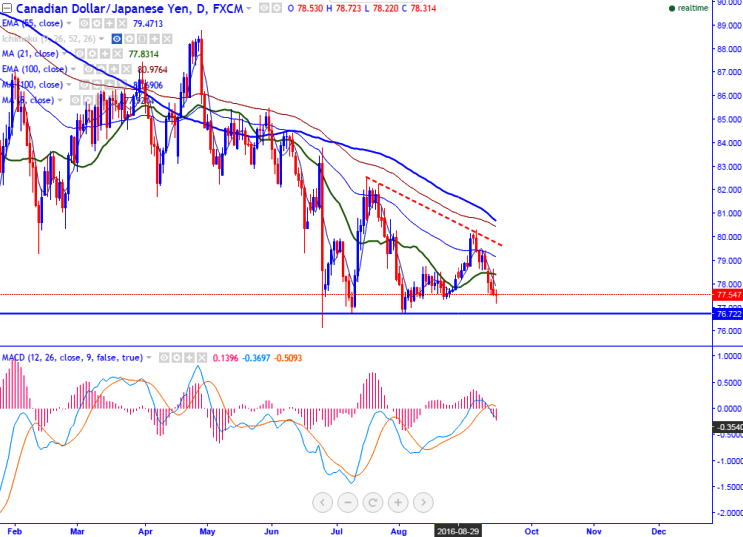

- Major resistance- 78.83 (10- day MA)

- Major support -76.75 (Aug 3rd 2016 low)

- CAD/JPY has jumped till 78.63 yesterday and declined sharply from that level. It is currently trading around 77.55.

- The pair is facing strong resistance at 10- day MA AT 78.83 any short term bullishness only above that level. The minor resistance is around 78.27 (5 day MA).

- Any break above 78.27 will take the pair till 78.85 (10- day MA)/79.22 (55- day EMA).

- On the lower side, any break below 76.75 will drag the pair to next level till 76.10/74.55 (161.8 % retracement of 76.12 and 80.31).

It is good to sell on rallies around 77.85-77.90 with SL around 78.80 for the TP of 76.10/74.60