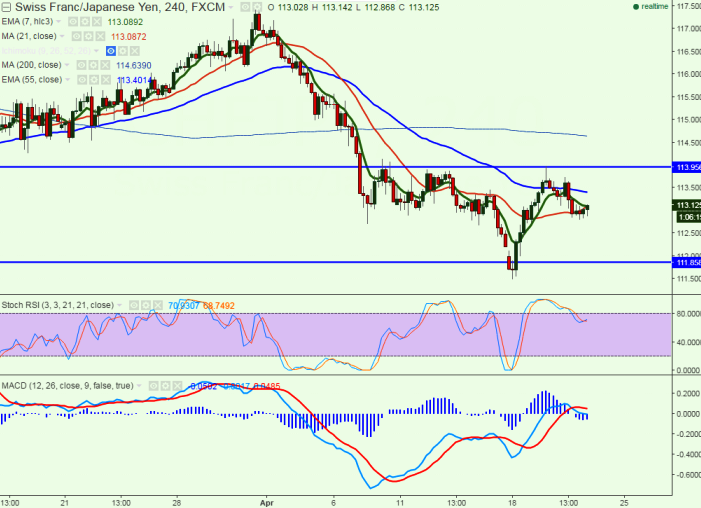

- Major resistance – 114

- Major support – 112.80

- The pair has made a slightly recovered after making a low of 112.80. It is currently trading at 113.10

- Short term trend is slightly bullish as long as support 112.80 (Tenken-Sen) holds.

- On the higher side any break above 114 will take the pair to next level 114.45 (Kijun-Sen)/115.20 (55 day EMA)/116.

- Any violation below 112.80 will drag the pair till 112/111.49 (18th Apr 2016 Low).

- Overall bullish invalidation only below 111.50.

It is good to buy at dips around 112.80 with SL around 112 for the TP of 114/115.20