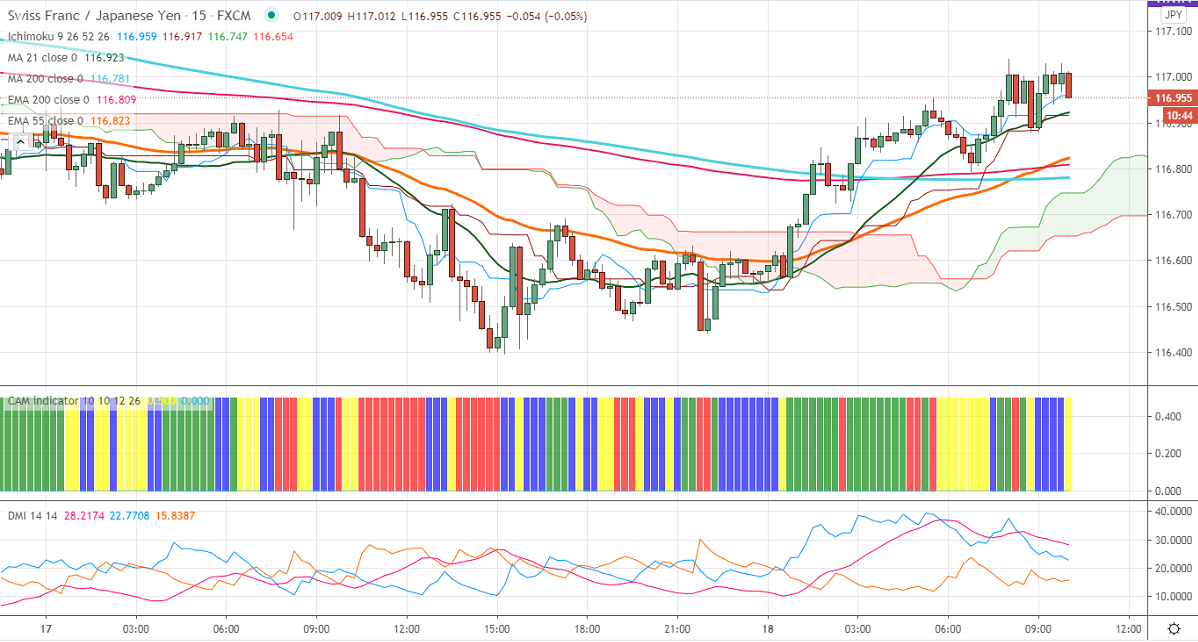

Ichimoku analysis (15 min chart)

Tenken-Sen- 116.91

Kijun-Sen- 116.95

CHFJPY took support near 200- 15 min MA and shown a minor recovery. The slight weakness in yen due to easing demand for safe-haven assets. The Bank of Japan has extended its Coronavirus lending program on rising COVID-19 cases. USDJPY surged to 103.59 from the minor bottom of 102.85. Any cross above 103.60 targets 104/104.60. The intraday trend of CHFJPY remains bullish as long as support 116.35 holds.

Technical:

The pair's strong resistance is at 117.05, violation above will take to the next level117.50/117.80. On the lower side, near term support is around 116.85, and any indicative break below targets 116.35/116/115.38.

Indicator (15 min chart)

CAM indicator –Neutral

Directional movement index –bullish

It is good to buy on dips around 116.75-80 with SL around 1 for the TP of 115.38.