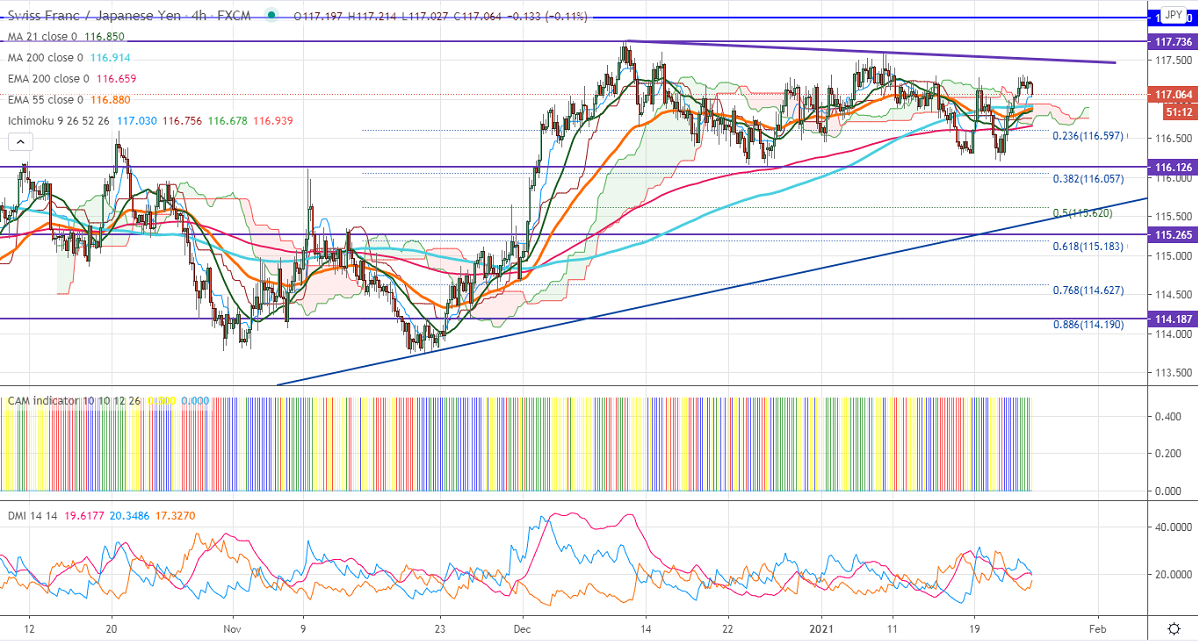

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 117.03

Kijun-Sen- 116.75

CHF/JPY has formed a double bottom near 116.10 and shown a minor recovery of more than 100 pips on the strong Swiss franc. It is trading higher against the US dollar; any jump above 0.8920 confirms a bullish continuation. USDJPY is consolidating in a narrow range between 103.33 and 140.39 for the past ten days. Significant trend reversal only if it breaks 104.40. The intraday trend of CHFJPY remains bullish as long as support 116.15-20 holds.

Technical:

The pair's strong resistance is at 117.30, violation above will take to the next level 117.60/118.05/118.60. On the lower side, near term support is around 116.90, and any indicative break below targets 116.60/116/115.84.

Indicator (4-hour chart)

CAM indicator –Bullish

Directional movement index –Neutral

It is good to buy on dips around 116.90 with SL around 116.40 for the TP of 118.60.