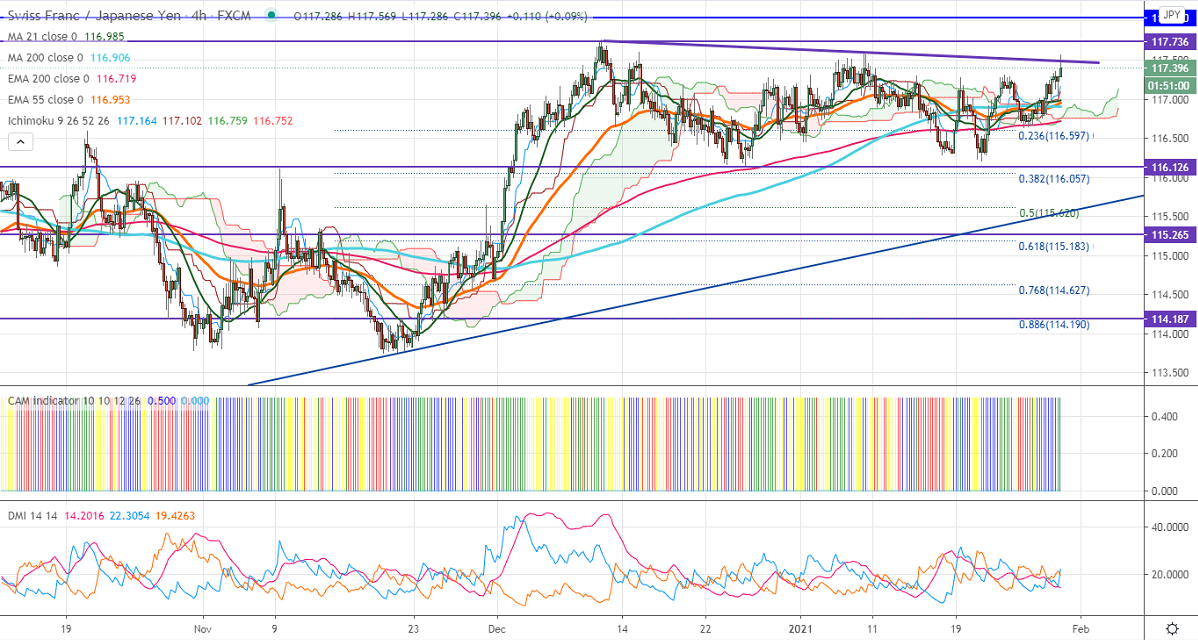

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 116.81

Kijun-Sen- 116.75

CHF/JPY has shown a minor recovery after forming a bottom at 116.62. The slight weakness in the yen is supporting the pair at lower levels. USDJPY is trading higher, any convincing break above 104.40 confirms a bullish continuation. USDCHF has once again declined after hitting a high of 0.89187. Any jump above 0.8925 confirms a bullish continuation. The intraday trend of CHFJPY remains bullish as long as supports a 116.60 hold.

Technical:

The pair's strong resistance is at 117.76, violation above will take to the next level 118.05/118.60. On the lower side, near term support is around 117, and any indicative break below targets 116.60/116/115.84.

Indicator (4-hour chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to buy on dips around 116.60 with SL around 116.20 for the TP of 118.60.