FxWirePro: CHFJPY Daily Outlook

Ichimoku analysis (Hourly chart)

Tenken-Sen- 117.25

Kijun-Sen- 117.39

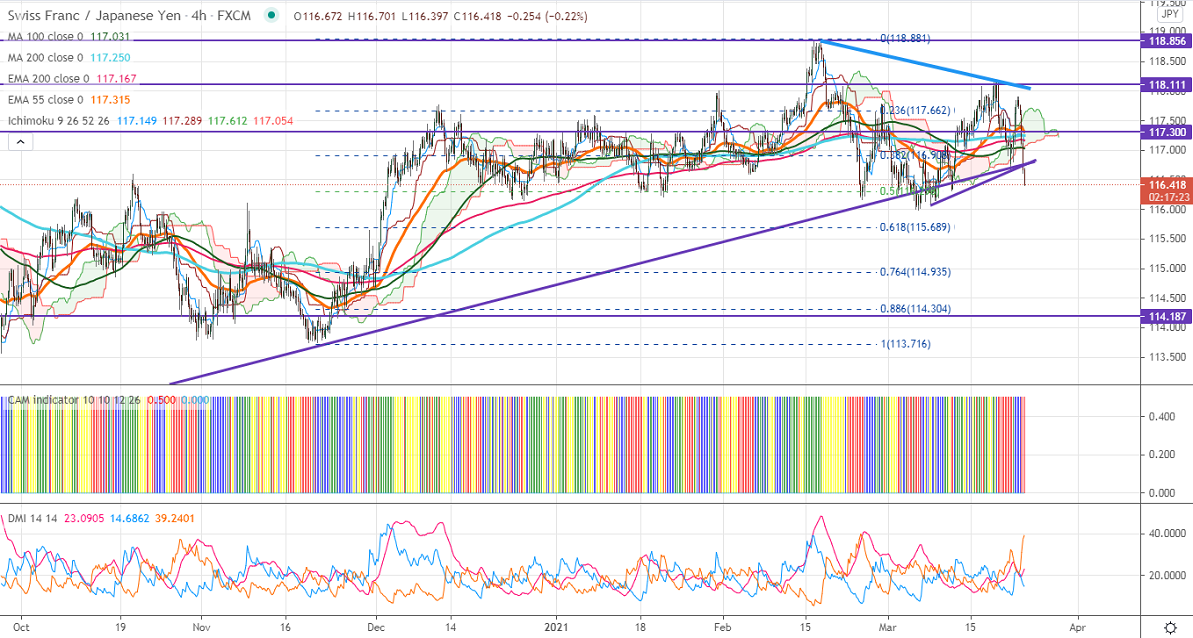

As per our analysis, CHF/JPY continues to trade weak trading weak after a minor jump to 117.90. The weakness in the Swiss franc against all majors is dragging the pair further down. USDCHF has broken significant resistance 0.93250 after a long consolidation. USDJPY has taken support near 100- 4H MA and shown a minor recovery. Major weakness only if it breaks 108.30. The intraday trend of CHFJPY remains bearish as long as resistance 118.85 holds.

Technical:

The pair's strong support is at 116.30, any break below confirms minor weakness, and a dip till 116/115.68 likely. On the higher side, near-term resistance is around 117.05, and any indicative break above targets 117.35/117.85/118.20.

Indicator (Hourly chart)

CAM indicator – Bearish

Directional movement index – bearish

It is good to sell on rallies around 116.60-65 with SL around 117.05 for a TP of 115.