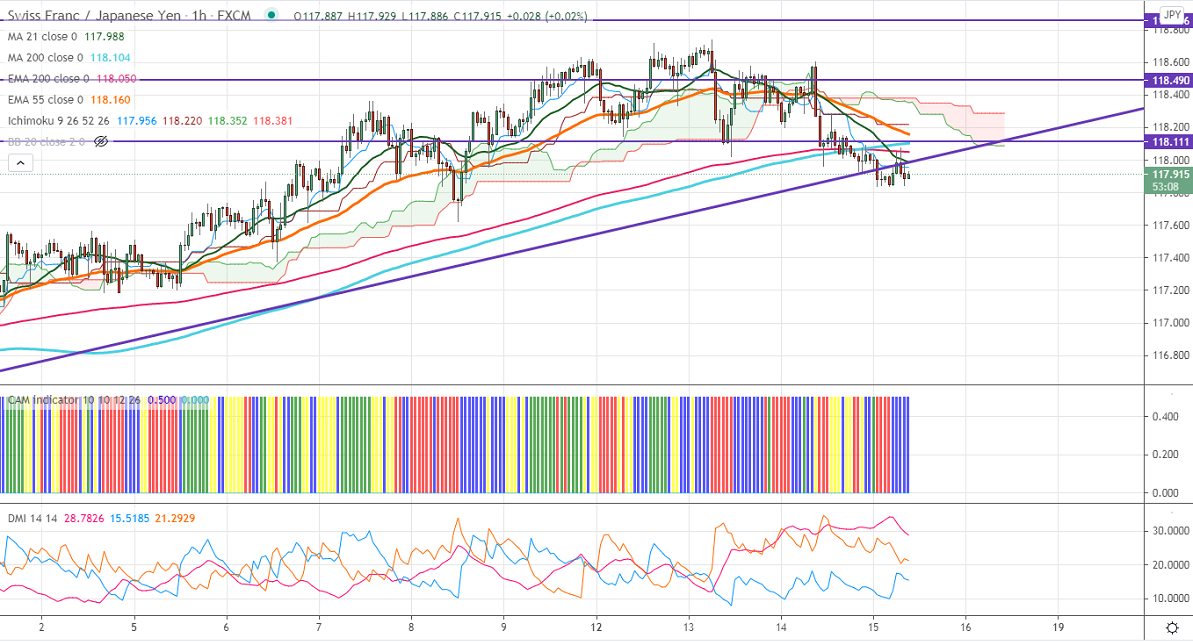

Ichimoku analysis (Hourly chart)

Tenken-Sen- 117.95

Kijun-Sen- 118.22

CHF/JPY declined more than 90 pips from a high of 118.74. The intraday trend is on the lower side as long as resistance 118.85 holds. The strength in the Japanese yen is putting pressure on this pair. USDJPY has formed a temporary top around 110.96 and lost more than 200 pips on broad-based US dollar selling. The slight weakness in US bond yield also supporting Yen. USDCHF continues to trade weak for 3rd consecutive days.

Technical:

The pair's strong support is at 117.60, any break below confirms minor weakness, and a dip till 117.20/116.90/116.09 likely. On the higher side, near-term resistance is around 118.85 (Feb 17th high), and any indicative break above targets 119.60/120.40.

Ichimoku Analysis- The pair is trading below hourly Kijun-Sen, Tenken-Sen, cloud, and 200-MA.

Indicator (Hourly chart)

CAM indicator – Slightly Bullish

Directional movement index – Bearish

It is good to sell on rallies around 118.25-30 with SL around 118.85 for a TP of 117.