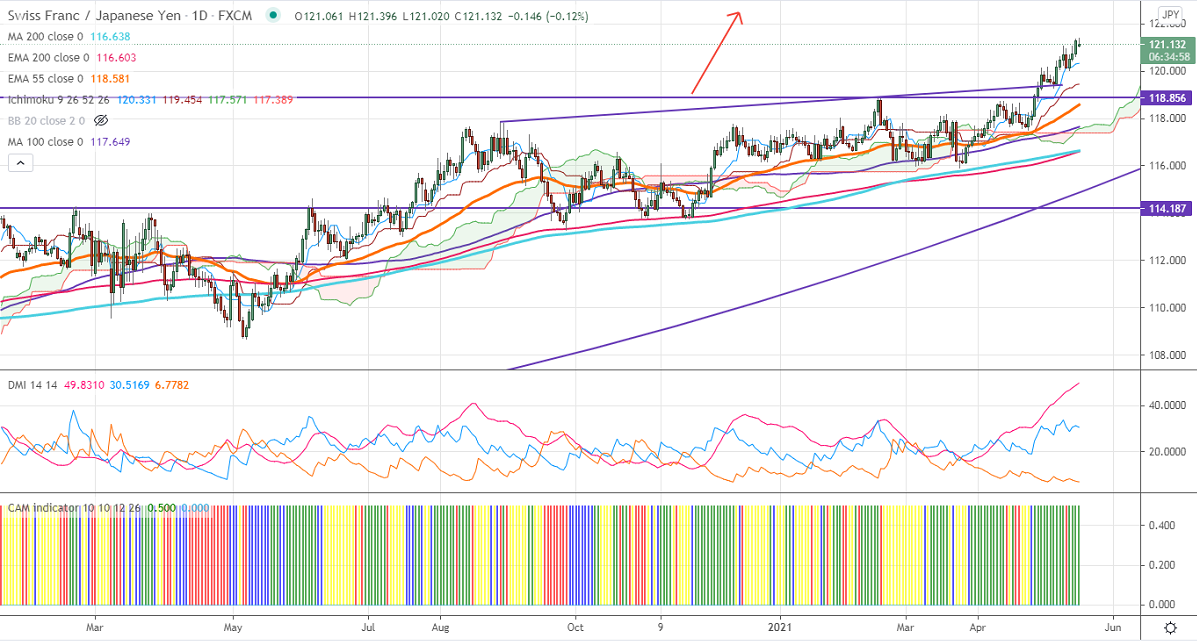

Ichimoku analysis (Daily chart)

Tenken-Sen- 120.30

Kijun-Sen- 119.42

CHF/JPY is consolidating after hitting a multi-year high at 121.39. The board-based Swiss-franc is supporting the pair at a lower level. The pair was one of the best performers in the past three weeks and surged nearly 300 pips. USDCHF continues to trade weak for the past six weeks on US dollar selling. USDJPY jumped after hitting a low of 109.07 on a surge in US bond yield. Minor bullish continuation only above 110. The intraday trend of CHFJPY is bullish as long as support 120 holds.

Intraday analysis-

Trend – Bullish

The pair is holding above daily Kijun-Sen, Tenken-Sen, and cloud. On the lower side, near-term support is around 120. Any violation below will drag the pair down to 119.25/118.60/117.95/116 likely. The immediate resistance is only 121.25. Any violation above that level will take the pair to next level to 122/123/124.45.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 120.50-55 with SL around 120 for a TP of 122.