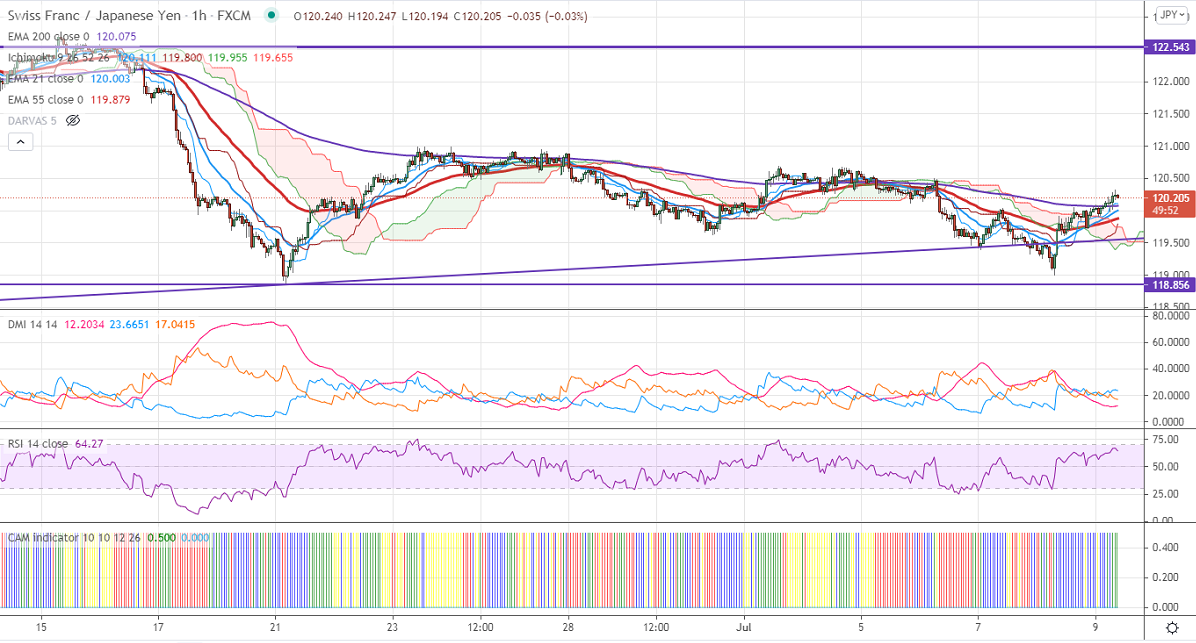

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 120.11

Kijun-Sen- 119.65

CHF/JPY has halted its two weeks of losing streak and recovered more than 150 pips from the minor bottom 118.99. The minor pullback in USDJPY on as US bond yields recovers. It is holding above 110 levels. The Swiss-franc gained sharply on Safe-haven demand. USDCHF hits two weeks low, any close below 0.9140 confirms further weakness.

Intraday analysis-

Trend – Bearish

The pair is trading above 1-hour Tenken-Sen, Kijun-Sen, and cloud. The near-term resistance is around 121. Any violation above targets 122/123. The immediate support is around 120. Any decline below that level will take the pair to 119.60/118.80/118.50.

Indicator (1-Hour chart)

CAM indicator –Bullish

Directional movement index –Neutral

It is good to sell on rallies around 120.20-25 with SL around 121 for a TP of 118.