Major Intraday resistance -150.20

Intraday support- 149.50

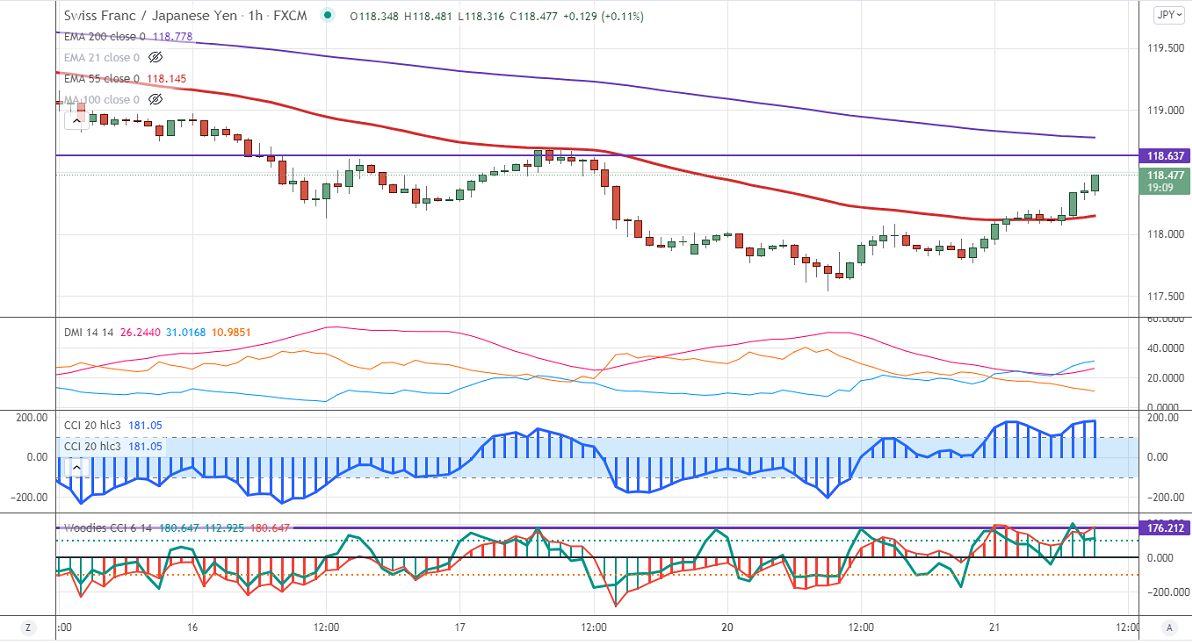

CHFJPY recovered more than 100 pips from the minor bottom 117.54 on board-based Swiss franc strength. The risk aversion in global markets due to Evergrande financial is supporting the Swiss franc at lower levels. It hits an intraday high of 118.47 and is currently trading around 118.434.

CCI and Woodies CCI analysis-

Both CCI (50) and Woodies CCI is above zero lines (bullish trend)

2. It has formed Zero line reject (CCI (14) has declined from 191 to 71 and now trading around 167.

In Woodies CCI six consecutive bars above zero confirms intraday bullishness.

Technically, near-term support is around 118 and any indicative break below will drag the pair down till 117.54/117.

The immediate resistance is at 118.78, any convincing break targets 119.60/120.

It is good to buy on dips around 118.40-42 with SL around 118.12 for the TP of 118.80/119.25.