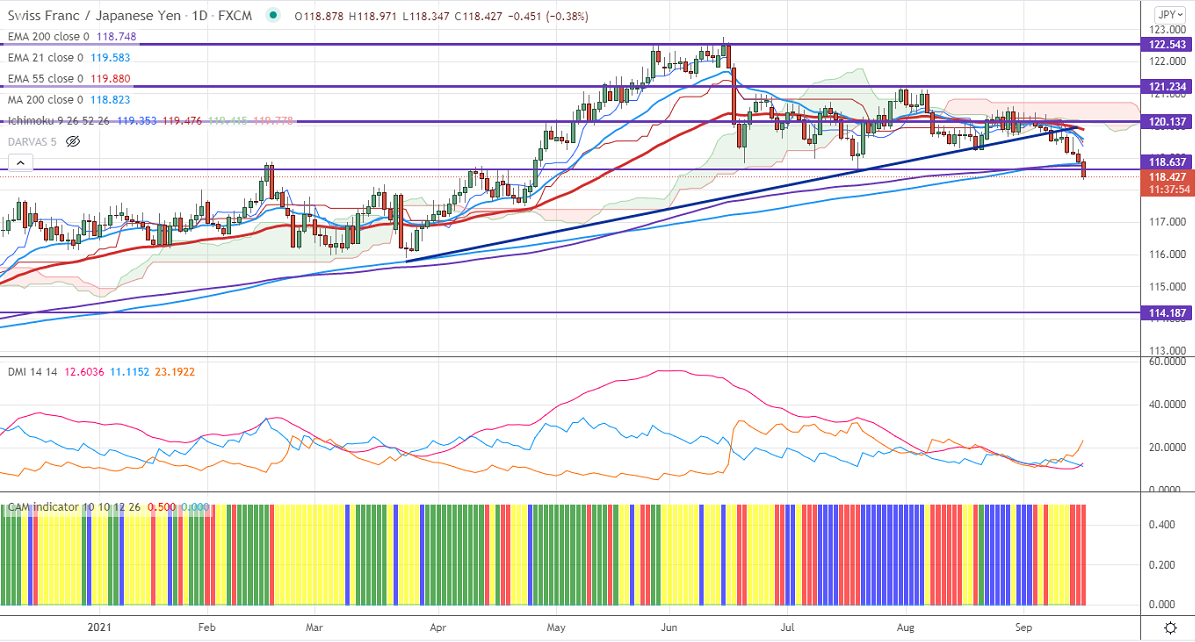

Ichimoku Analysis (Daily chart)

Tenken-Sen- 119.62

Kijun-Sen- 119.715

CHFJPY is trading weak for the past 10 days on board–based Japanese yen strength. The pair has broken significant support 118.81 (200-day MA) after a long consolidation. It hits an intraday high of 118.36 and is currently trading around 118.38.

USDCHF Analysis

The pair hits one month high on US dollar strength. Any breach above 0.9240 confirms intraday bullishness.

USDJPY

USDJPY is losing momentum on declining US bond yields. Major support to be watched is 109.

Technically, near-term support is around 118 and any indicative break below will drag the pair down till 117/115.90.

The immediate resistance is at 118.75, any convincing break targets 119.60/120.

It is good to sell on rallies around 118.65-70 with SL around 119.60 for the TP of 115.90.