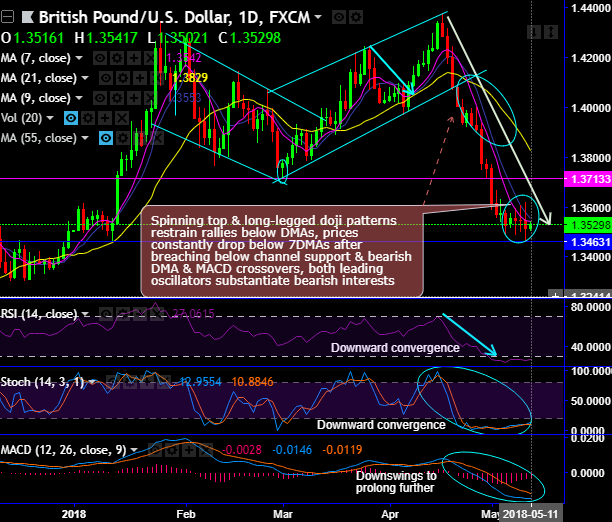

Cable forms 3-black crows which is bearish in nature on weekly plotting. While spinning top and long-legged doji patterns restrain today’s rallies below DMAs, bears have managed to breach below channel support on 20th April (refer daily chart).

Ever since then the prices constantly drop below 7DMAs after breaching below channel support & bearish DMA & MACD crossovers, both leading oscillators substantiate bearish interests

While on weekly plotting as well, the bears resume at channel resistance in the consolidation phase. As a result, the price slides below EMAs and channel support, while both leading and lagging indicators on this timeframe are in tandem with downswings.

For now, more dips likely on bearish DMA and MACD crossovers that indicate downtrend to prolong further.

The next strong support is observed at 1.3463 levels, the bulls have tested this level yesterday, subsequently, dragged the rallies today.

Since the pair pops up streaks of bearish indications, we could foresee more downside potential, we prefer to deploy ATM delta put options on both trading as well as hedging grounds.

Unlike a trade in the underlying whose value per point stays the same, the value of an option for every point’s movement in the underlying is constantly changing.

The Delta can be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option’s value will increase or diminish as the underlying market moves.

They carry the highest gamma, vega, and theta which means their premium is the most sensitive to moves in either direction. Moreover, the delta of ATM options is 50%, which means there is an even likelihood of expiring ITM or OTM.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -29 levels (which is bearish). Hourly USD spot index was at shy above -137 (highly bearish) while articulating (at 10:38 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: