What else does the FX market need? It gets positive news from the Brexit negotiations, and the prospect of the EU summit this week declaring “sufficient progress” is as good as it could possibly be. But Sterling was only able to benefit for one single day. On Friday and also today on the Asian markets there is no evidence of this any longer.

Even after the politically motivated agreement, the negotiations will remain very difficult on a technical level. The symbolic value of the recent agreement is all very well. And it justifies a lack of renewed Sterling weakness. But it is still too early for a sustainable recovery of the British currency.

It’s important to recognize that a less assertive BoE outlook is not the only factor weighing on GBP. In particular, the GBP TWI has now given back 80% of the gains it made following the hawkish September MPC. We expect the Bank of England’s MPC to keep rates on hold through 2018 and, ultimately, to be forced into further easing, against a backdrop of tighter policy elsewhere. All of which will anchor sterling.

OTC outlook and options strategy:

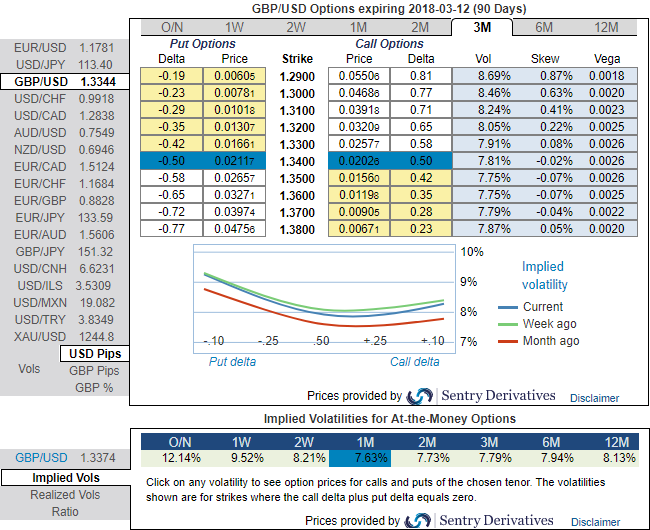

Let’s glance at sensitivity tool and risk reversals that indicate no changes in the hedging sentiments for bearish risks of the underlying spot FX prices.

Positively skewed IVs of 3m tenors have been signifying the hedgers’ interests of OTM put strikes that means the ATM puts the higher likelihood of expiring in-the-money. ATM IVs are still stuck between 7.6 to 7.95% range for 1-6M tenors.

Hence, in order to arrest this upside risk that is lingering in intermediate trend and major declining trend, we recommend options strap strategy that favors underlying spot’s upside bias and mitigates any abrupt bearish risks.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 1m expiries, these options positions construct smart hedging at net debit.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -97 levels (which is bearish). While hourly USD spot index was at shy above -52 (bearish) while articulating (at 09:34 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge