The global economy is surfing a cyclical upturn, and financial markets have been gorging on central bank accommodation, but as post-crisis policies are dismantled, the appearance of calm in FX-land risks being deceptive.

One phase of last week's price action that was instructive as a broad alpha theme in 2018 was SEK’s violent rally following the beat on the CPIF print for November (cons: 1.8% y/y, actual: 2.0% y/y, EURSEK -1.5% pre-to post-release). Riksbank's intransigence in holding Swedish deposit rates in negative territory despite boomy growth is a by now well-known –and unfortunately P/L-consuming – disconnect in currency circles.

Quiescent inflation is the missing ingredient that has so far permitted status quo on monetary policy, but as the reaction to the last print demonstrated, it only takes one above-consensus CPI number to set off a mini-eruption in the powder keg that is abnormally low-interest rates.

Sweden may be the poster child of the rates/growth divide in G10, but a number of other DM central banks are also in a similar, if less extreme, boat whose policy paths are subject to substantial re-thinks should inflation trajectories firm next year. As such, CPI releases are shaping up to be the most market moving calendar events for currencies in 2018, even more so than traditional activity data heavyweights such as PMIs and payrolls that by now enjoy a familiar constructive narrative and are less likely to catch markets off-guard with high-side prints.

For option investors, capturing event-driven surprises via pre-/ post-calendar spreads (selling pre-event options and buying post-event options in order to isolate and capture sharp spot moves/realized volatility) is a well-established ritual.

The good news is that this has proven to be on the whole a profitable strategy around CPI releases in the past, so one is swimming with rather than against the tide of historical evidence. The calendar straddle is implemented by selling a near-term straddle while buying a longer-term straddle with the intention to profit from the rapid time decay of the near term options sold. It is a limited profit, limited risk strategy.

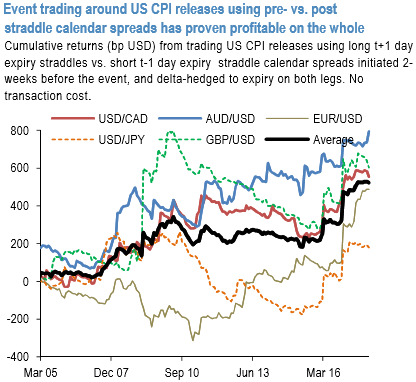

The above chart plots return streams of blindly plying short t-1-day vs. long t+1-day straddle calendars in various USD/G10 pairs around US CPI releases initiated 2weeks prior to each release, without any ex-ante judgment on rich/cheap of event pricing.

It has been an impressive that even such a naïve unfiltered strategy has generated positive returns over the years, especially during the years of upward inflation surprises during the 2005-’06 Fed cycle and a string of downside ones over the past 2-3 years. We also do not find it coincidental that smaller currencies like AUD and CAD that is not always the options markets’ focus for accurate event risk premium pricing of US inflation prints deliver better returns than more closely watched vol surfaces in majors such as EUR or JPY.

The allied hypothesis is that event trading less liquid data points such as Scandinavian and/or antipodean CPIs can yield a richer set of opportunities than G3 releases, as can employing non-traditional crosses less likely to be priced to perfection than first order, event-relevant majors (e.g. EURAUD or AUDJPY instead of AUDUSD around Australian CPIs etc). Courtesy: JPM

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data