AUD rose back above 0.7650 against US counterpart and 77.500 levels against Japanese Yen during the early Asian trading session on Monday as the risk currencies were buoyed by positive news coming from Europe.

Monthly inflation and PMI will be watched in Australia, but moves in AUD are likely to be driven by global risk sentiment.

How long can rising commodity prices continue to support AUD?

The stance on Aussie dollar from the current levels appears to be a unfold view on commodity prices, given little chance of a shift in bias from the Fed or RBA near term.

If commodities are appearing lathered up, then this should limit the upside for Aussie crosses (especially currency crosses such as AUDUSD AUDJPY etc), all else equal. In a recent review of the supply and demand fundamentals for iron ore, please be noted that there was little impetus to change price forecasts, and they continue to expect iron ore to average USD53/t in 2H16 and USD48/t in 2017.

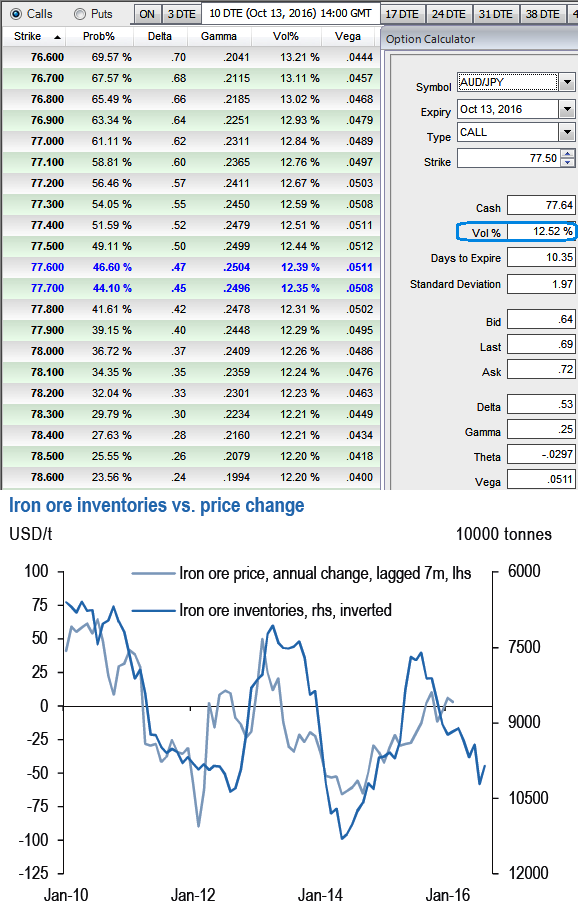

This outlook suggests that the current rise in iron ore prices is unlikely to sustain, and underscores our lack of enthusiasm to embrace a more positive outlook for AUD. Developments in China’s iron ore inventories are also supportive of lower commodity prices at some point (see above chart).

Option Strategy:

ATM IVs of AUDJPY is rising a shy above 12.5% as shown in the diagram the standard deviation these call option is flashing up at 1.97.

Contemplating the prevailing bullish sentiments in this pair and keeping the major trend in mind, we advocate diagonal call spreads are preferred to vanilla structures given elevated skew and favourable cost reduction.

So, buy AUDJPY 1w/3d call spread with strikes of 77.1733 – 78.231 for a net debit, use shorter expiry on the short leg.

The net delta of the position should be around 45 (ITM strike = 70 delta) and selling the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Favour optionality to directional trades. We are inclined to position for a partial retracement of the down move through call spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data