- Aussie remains weak this Tuesday after weak China PMI data. AUD/CAD down 0.21% on the day, slips below 5-DMA at 0.9846.

- China October official manufacturing PMI printed at 51.6, missing the estimate of 52.00 and down from the previous month's print of 52.4.

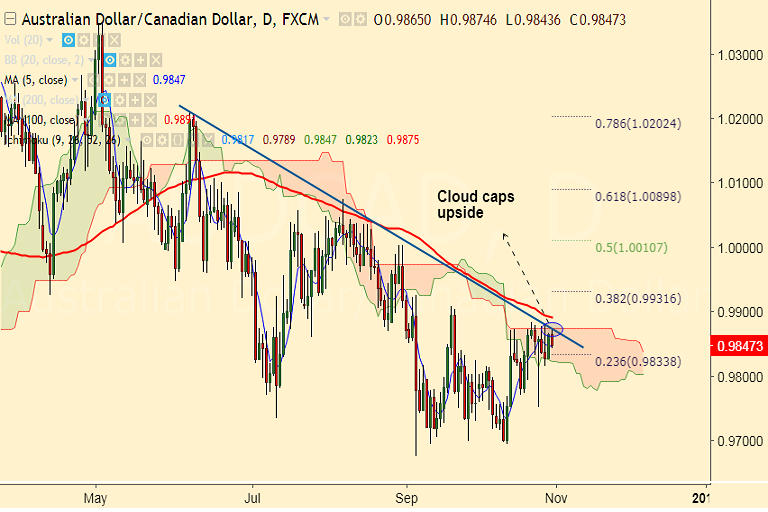

- Technical studies support upside on weekly charts. We see bullish divergence on RSI and Stochs which adds scope for upside.

- Weekly 20-SMA at 0.9877 caps upside. Daily cloud at 0.9875 is stiff resistance for AUD/CAD, upside only on break above.

- 100-DMA at 0.9891 is immediate resistance above daily cloud. Breakout at 100-DMA could see test of 200-DMA at 0.9999.

- On the flipside, 20-DMA at 0.9808 is strong support, weakness likely on break below.

- Focus on Canada August monthly GDP growth and Industrial Product Price Index ahead of the BoC Governor Poloz's speech later in the day for further impetus.

Support levels - 0.9846 (5-DMA), 0.9833 (23.6% Fib retracement of 1.0345 to 0.9675 fall), 0.9808 (20-DMA)

Resistance levels - 0.9875 (nearly converged daily cloud and weekly 20-SMA), 0.9891 (100-DMA), 0.99, 0.9931 (38.2% Fib retracement of 1.0345 to 0.9675 fall)

Recommendation: Good to go long on decisive break above 0.9875, SL: 0.9830, TP: 0.99/ 0.9930/ 1.00/ 1.0089.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -46.5105 (Neutral), while Hourly CAD Spot Index was at 26.7292 (Neutral) at 1040 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest